Product Management Portfolio

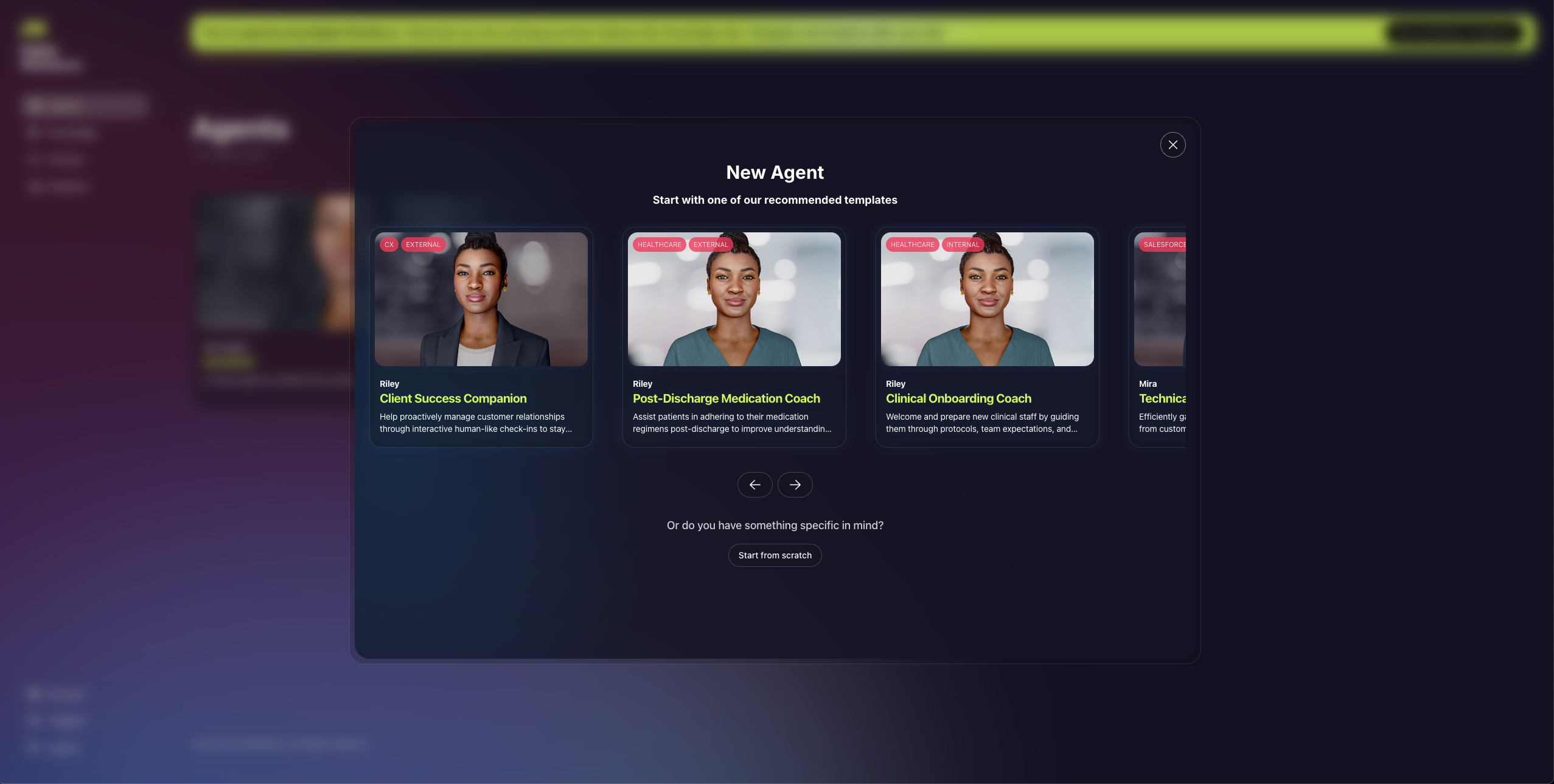

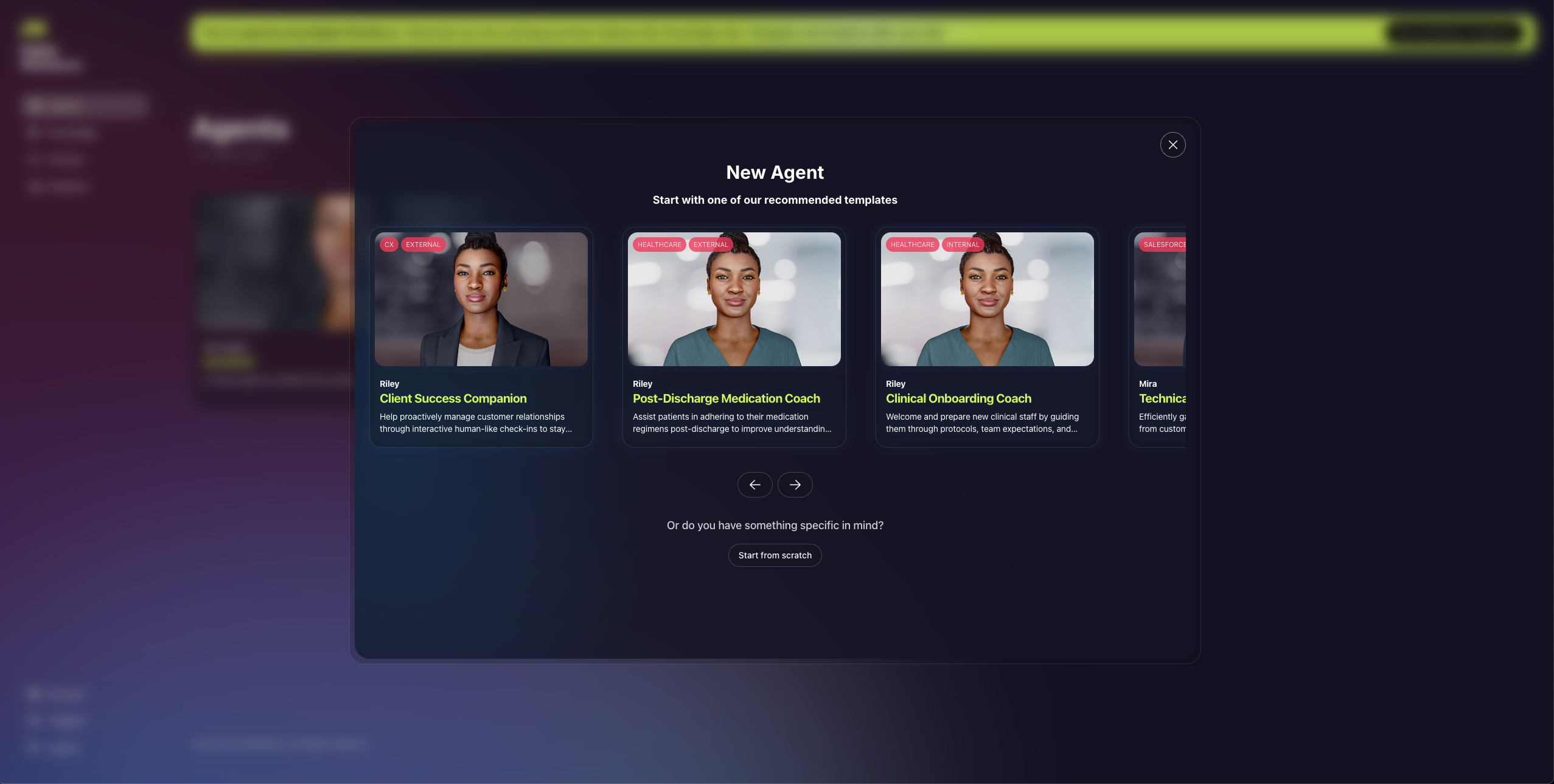

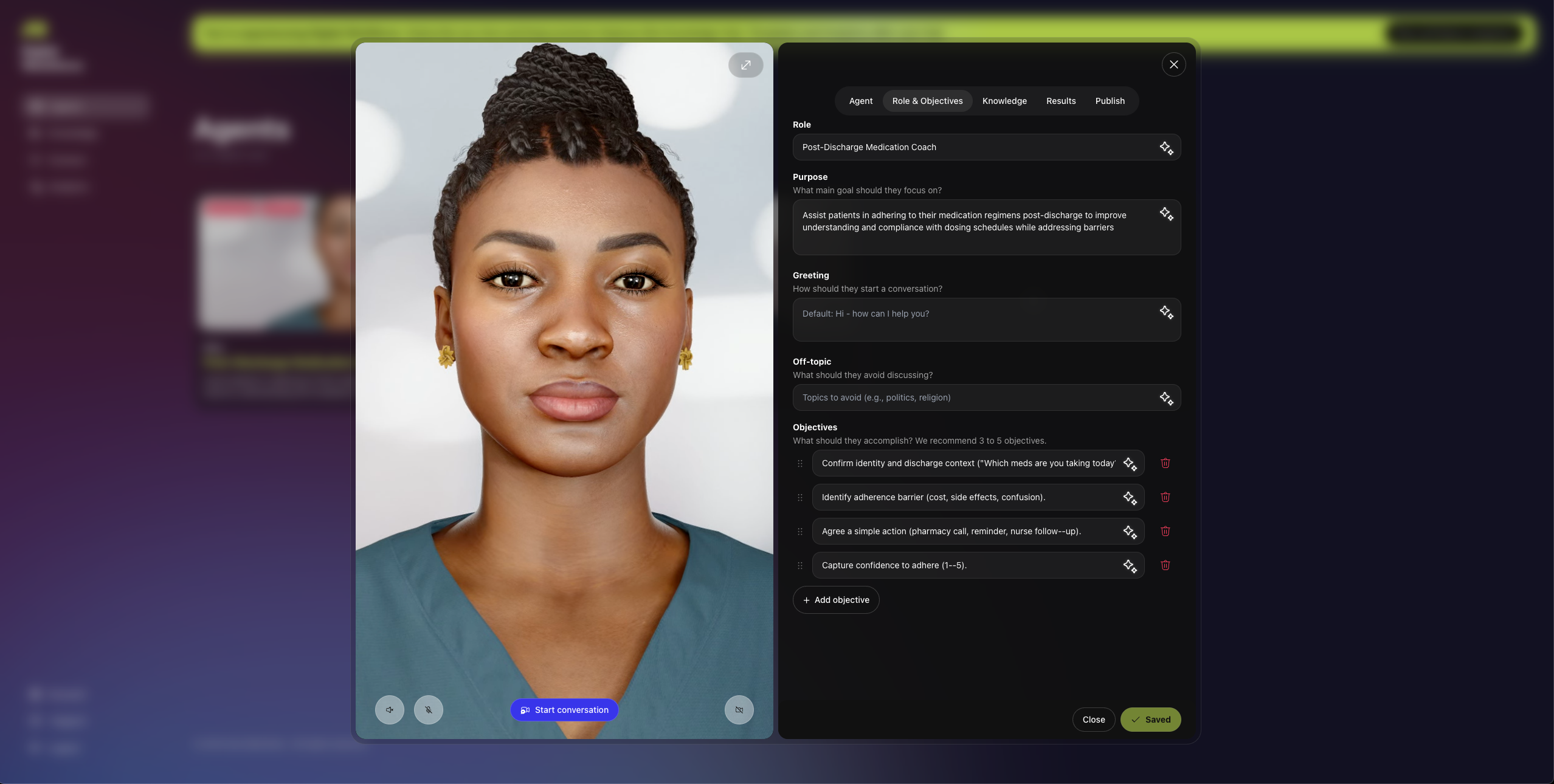

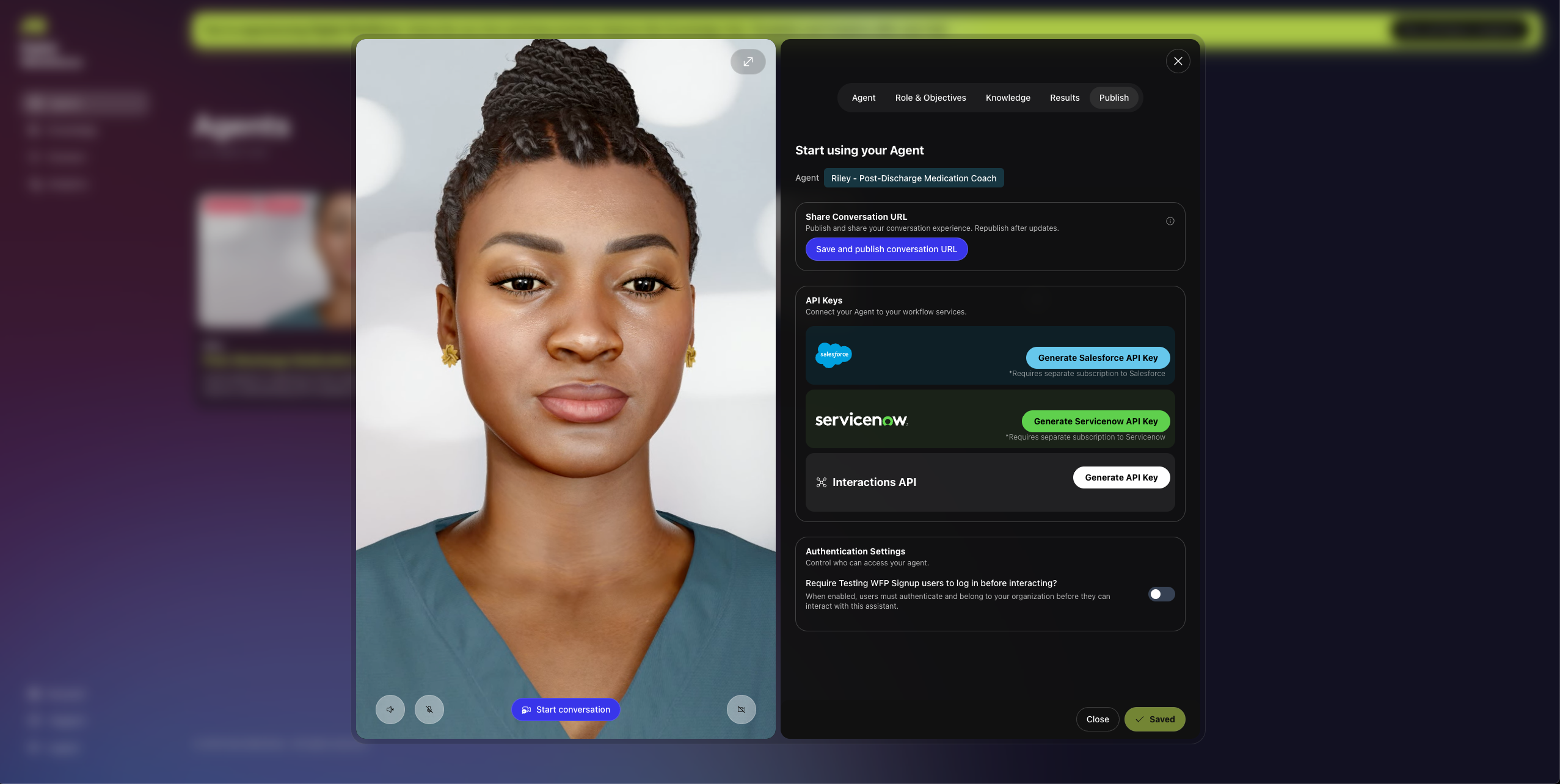

Digital Workforce: Enterprise-Ready AI with Ecosystem Integrations

Soul Machines

Soul Machines

Context

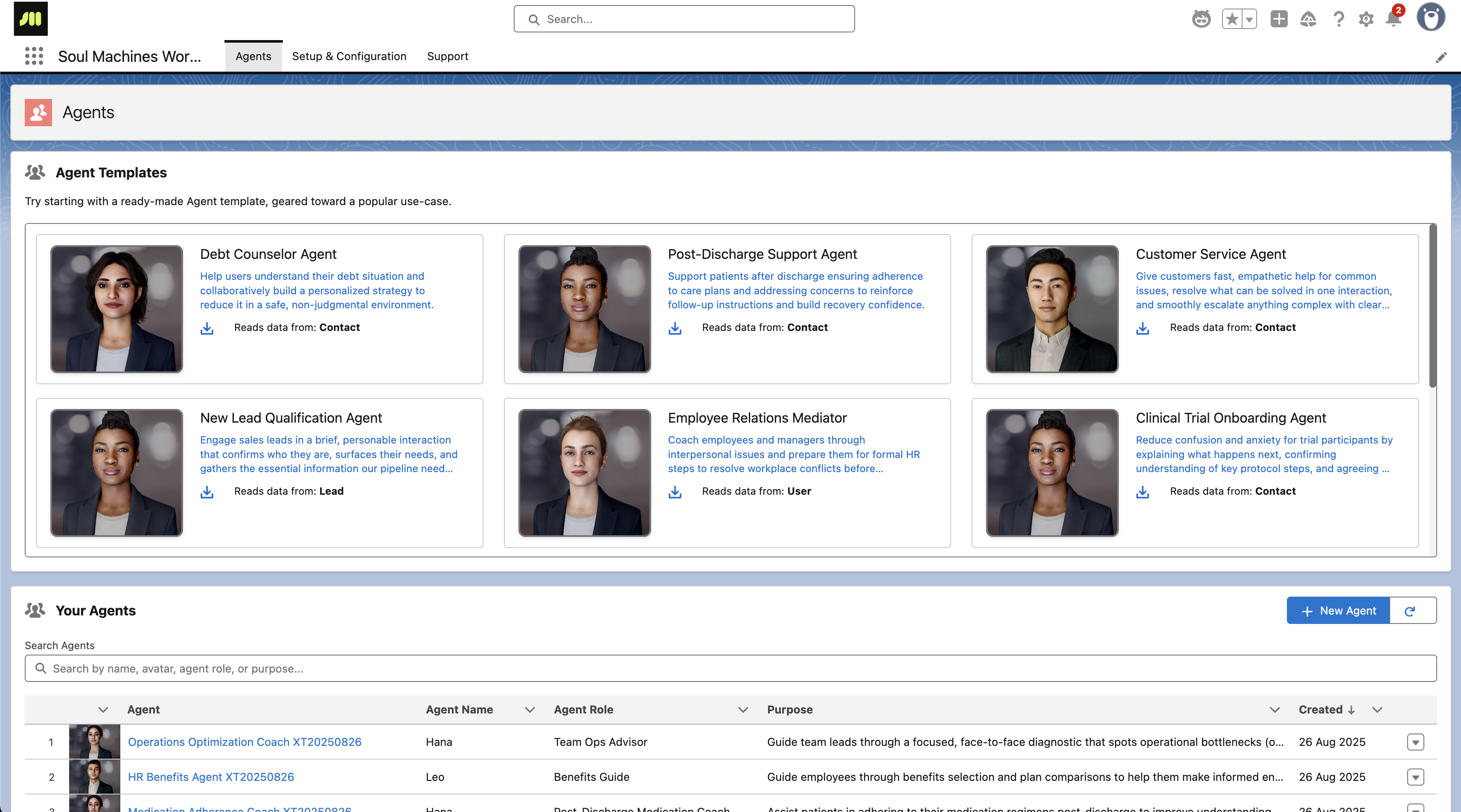

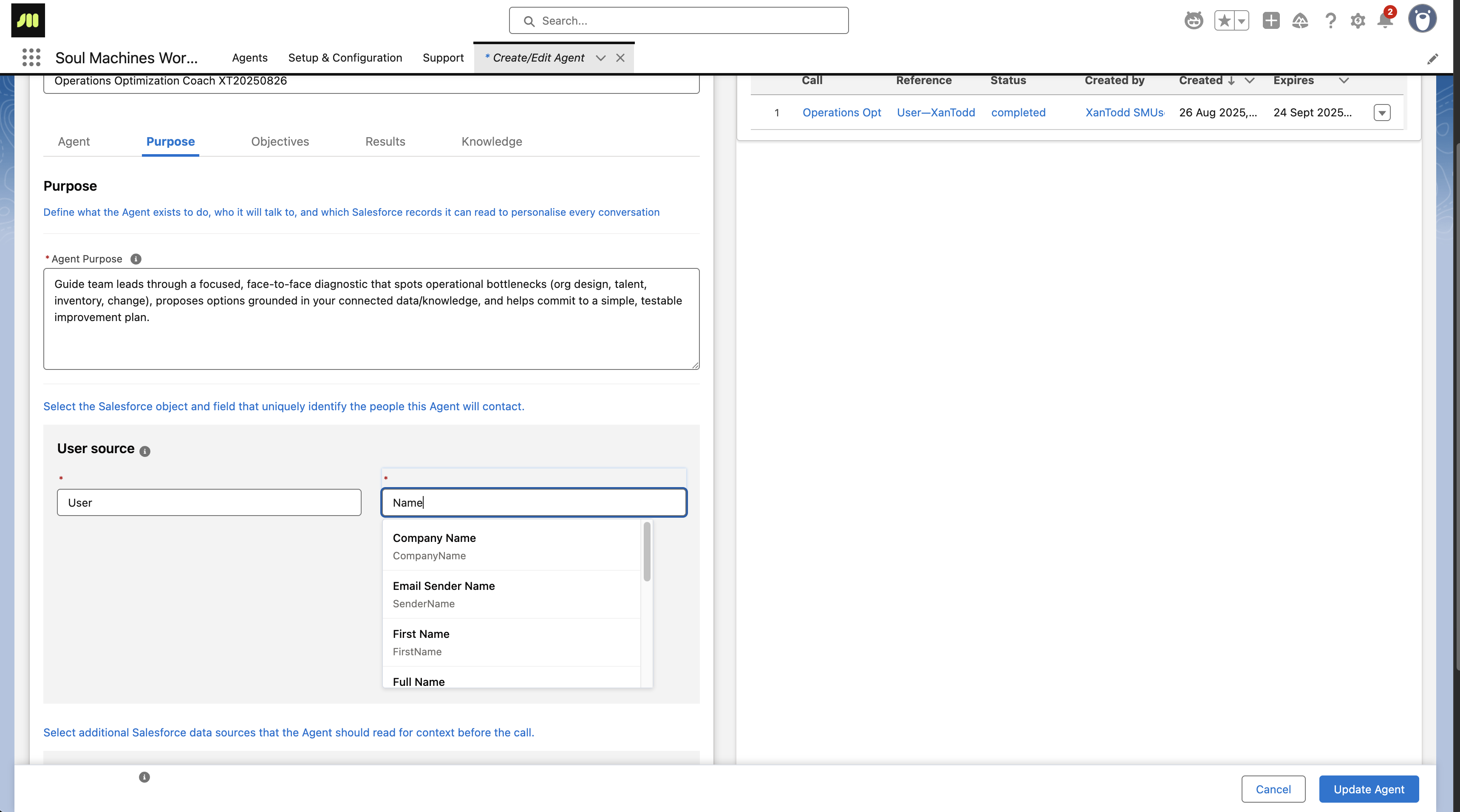

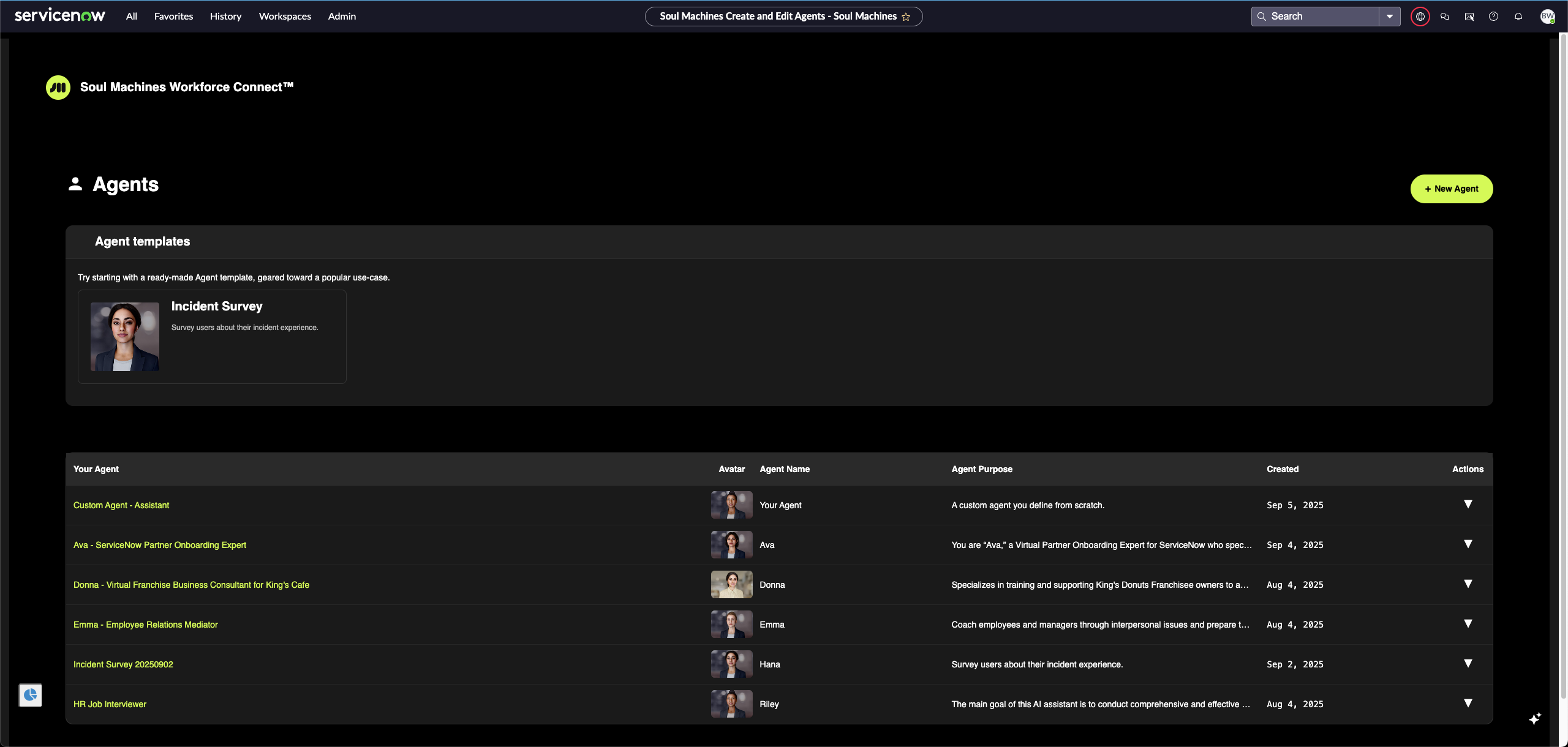

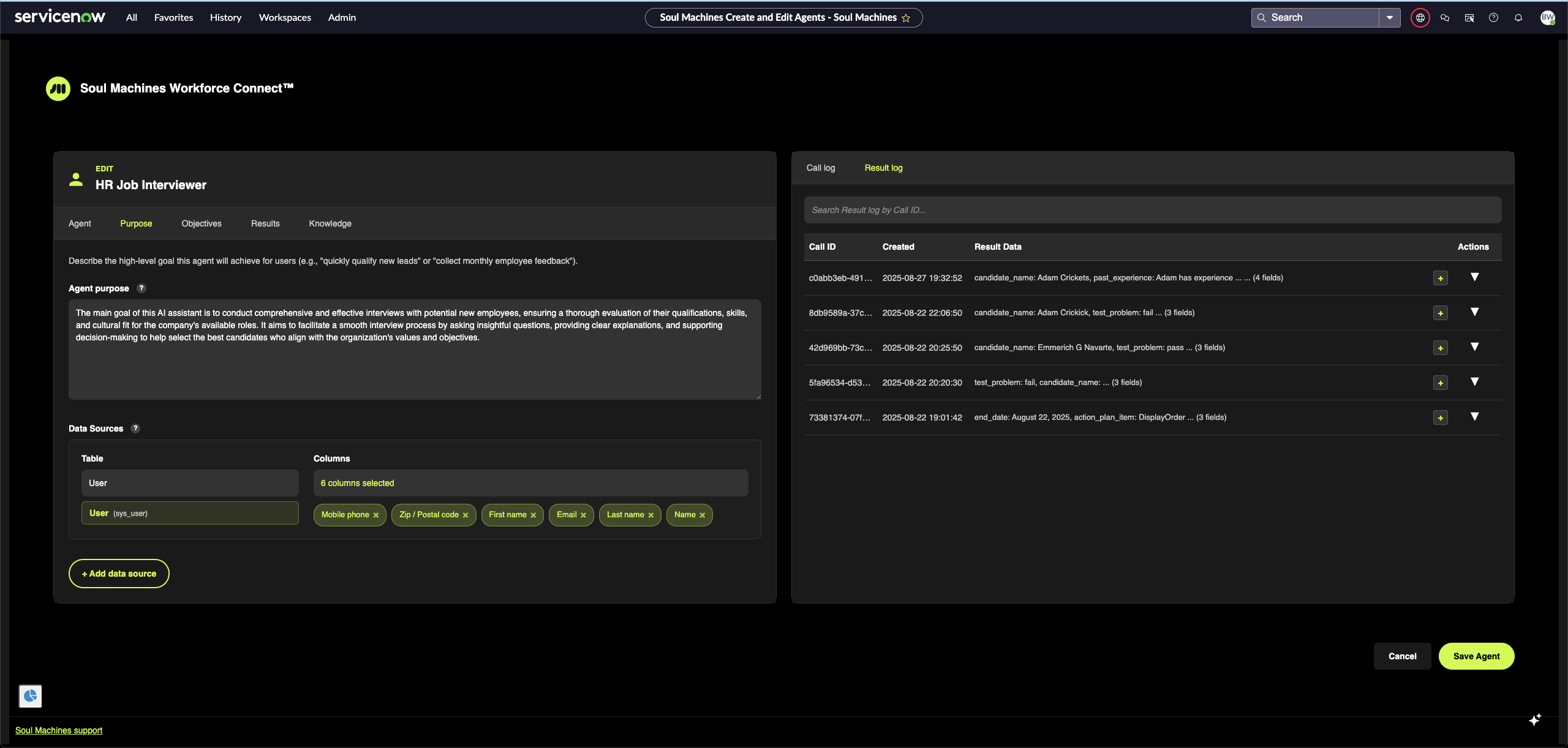

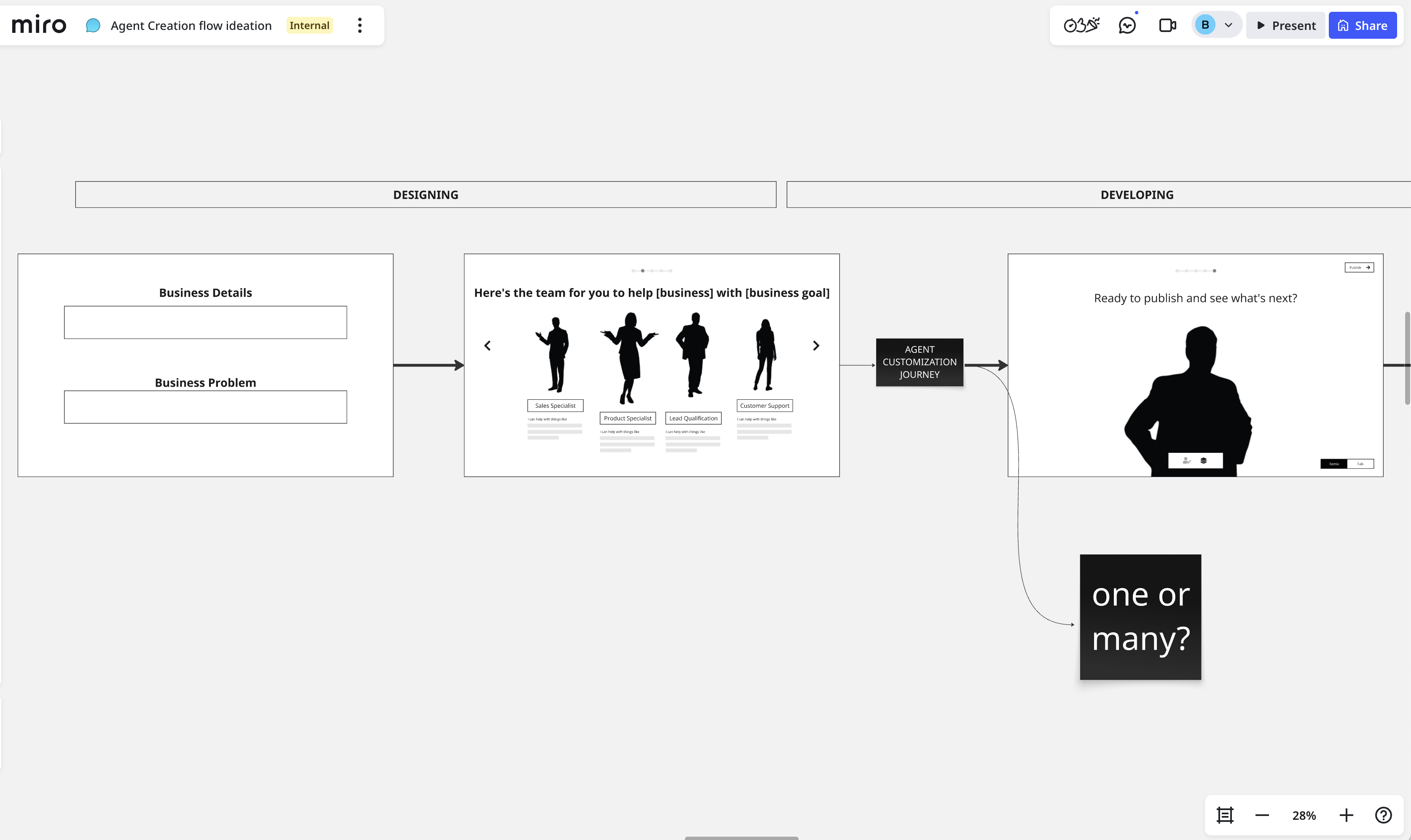

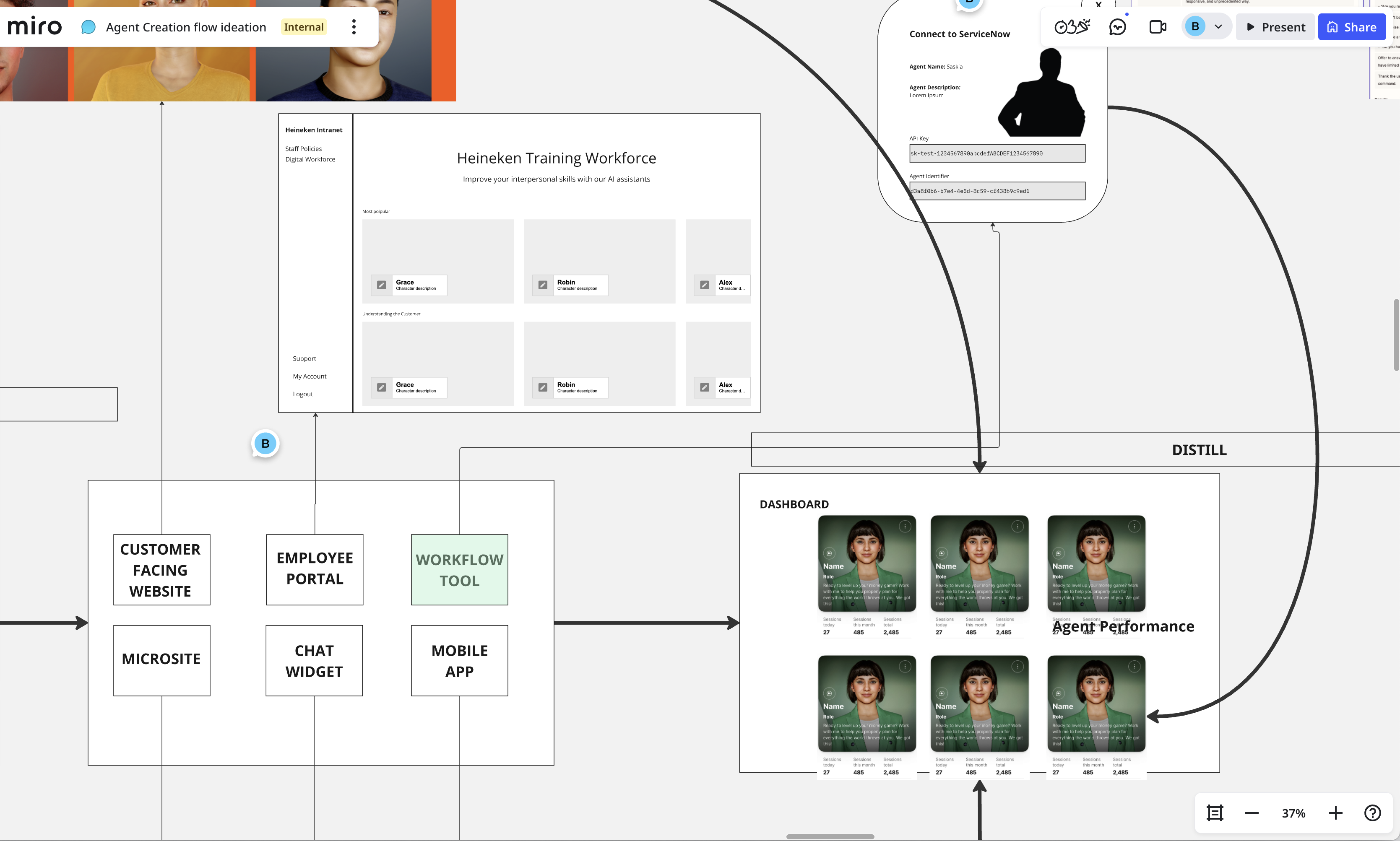

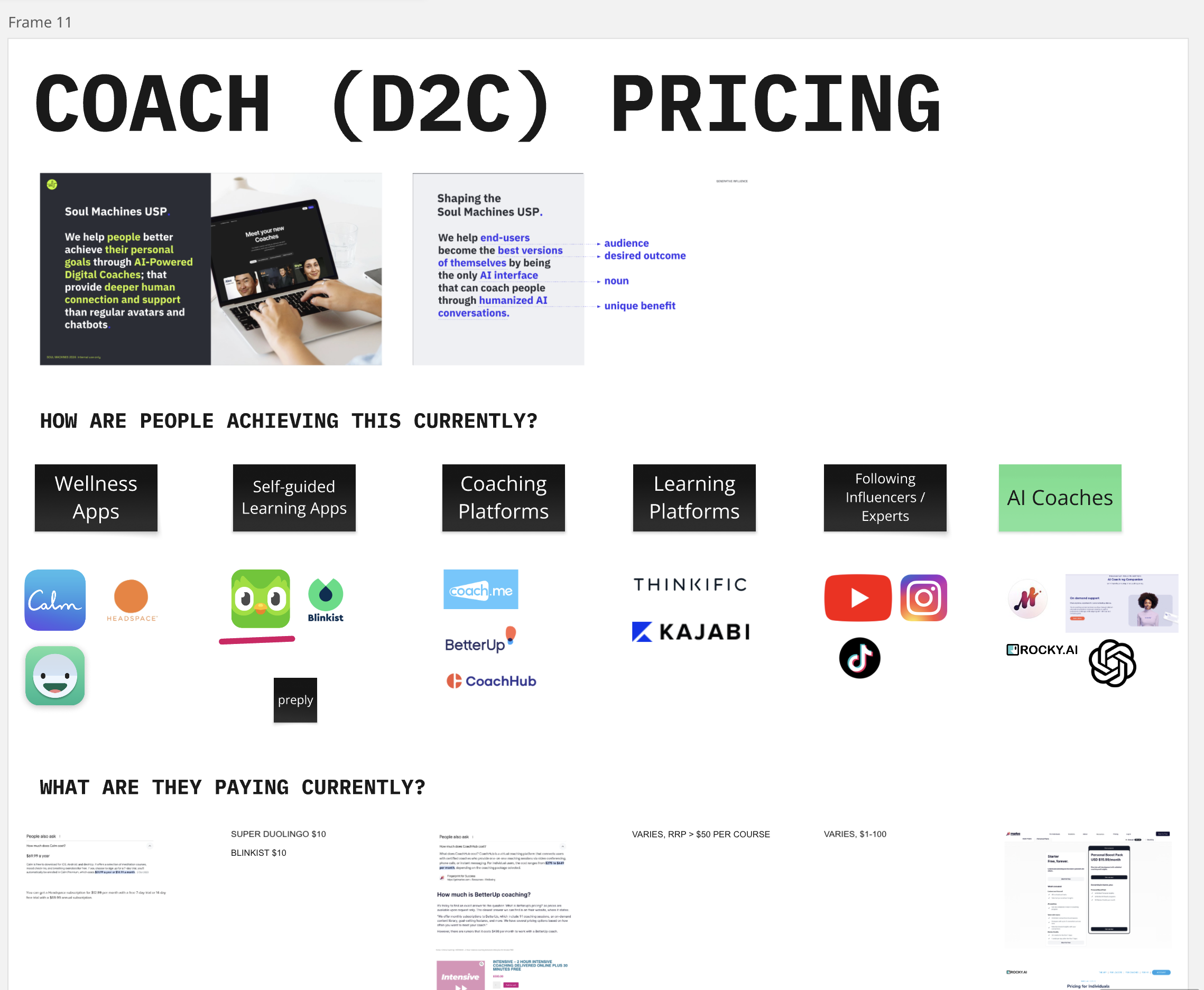

By 2023–2024, enterprises were looking beyond pilots and demos — they wanted deployable, scalable AI workers that could integrate into their existing systems (CRM, ITSM, ERP). At Soul Machines, I led the creation of the Digital Workforce product line, an enterprise-ready extension of our platform built around partner ecosystem integrations (Salesforce, ServiceNow, Zapier). This work involved reframing our category positioning as the empathetic face and embodiment layer for agentic AI—essentially an open, composable interaction layer that enterprises could buy and govern within their existing infrastructure. Our regulated-sector fit was particularly strong, with approximately 64% of our prior customer logos coming from Financial Services, Healthcare, and Education, giving us a proven procurement and compliance path that aligned perfectly with enterprise requirements.

Challenges

- From demo to deployment: earlier versions of digital people were compelling but lacked enterprise-grade integration.

- Procurement barriers: selling required procurement-ready packaging (apps in enterprise stores, entitlements, pricing clarity).

- Partner ecosystem: success depended on showing our product could live inside Salesforce, ServiceNow, and other enterprise workflows.

- Category clarity: needed to prove Digital Workforce was more than avatars — it was a scalable layer of agentic AI for enterprises.

- Security & procurement readiness: needed marketplace presence, standard entitlements/limits, SLAs, and partner IT/security packs.

What I Did

- Defined the strategy: positioned Digital Workforce as a 0→1 enterprise product line focused on extensibility and partner ecosystems. I applied Todd Jackson's 4 P's framework (Persona, Problem, Promise, Product) to systematically work toward product-market fit, starting with deep enterprise persona research and becoming experts in the specific integration problems facing Fortune 500 companies. This framework proved invaluable for prioritizing experiments and defining success metrics.

- Customer validation: ran enterprise demos, discovery, and co-design sessions with Fortune 500 clients to shape roadmap and prove value.

- API-first approach: re-architected product surfaces into primitives that could plug into Salesforce, ServiceNow, Zapier.

- Enterprise store apps: oversaw the development, packaging, and GTM of 3 packaged extensions (including AgentExchange, ServiceNow Store app) to streamline adoption and procurement.

- Cross-functional leadership: aligned PMs, Eng, Design, and GTM around entitlements, packaging, and SLA definitions.

Results

- Enterprise adoption: landed 3 new enterprise deals in 2025 directly tied to the Digital Workforce offering.

- Ecosystem traction: Shipped a coherent AI Workforce platform with three enterprise apps (AgentExchange, ServiceNow Agent Store, Zapier) and a REST API so customers embed value where work happens. Result: 500 signups since launch on April 1st, 2025.

- Market validation: won the ServiceNow Innovation Award (2025) and was selected as a company to watch at the ServiceNow Global Partner Summit.

- Strategic impact: reframed company positioning around agentic AI + human face layer, with Digital Workforce as the enterprise-ready embodiment.

- Scalability: created a series of high value use-case templates for repeatable integrations, setting the foundation for client success.

Defining Customer Value for Digital People

Soul Machines

Soul Machines

Context & Challenge

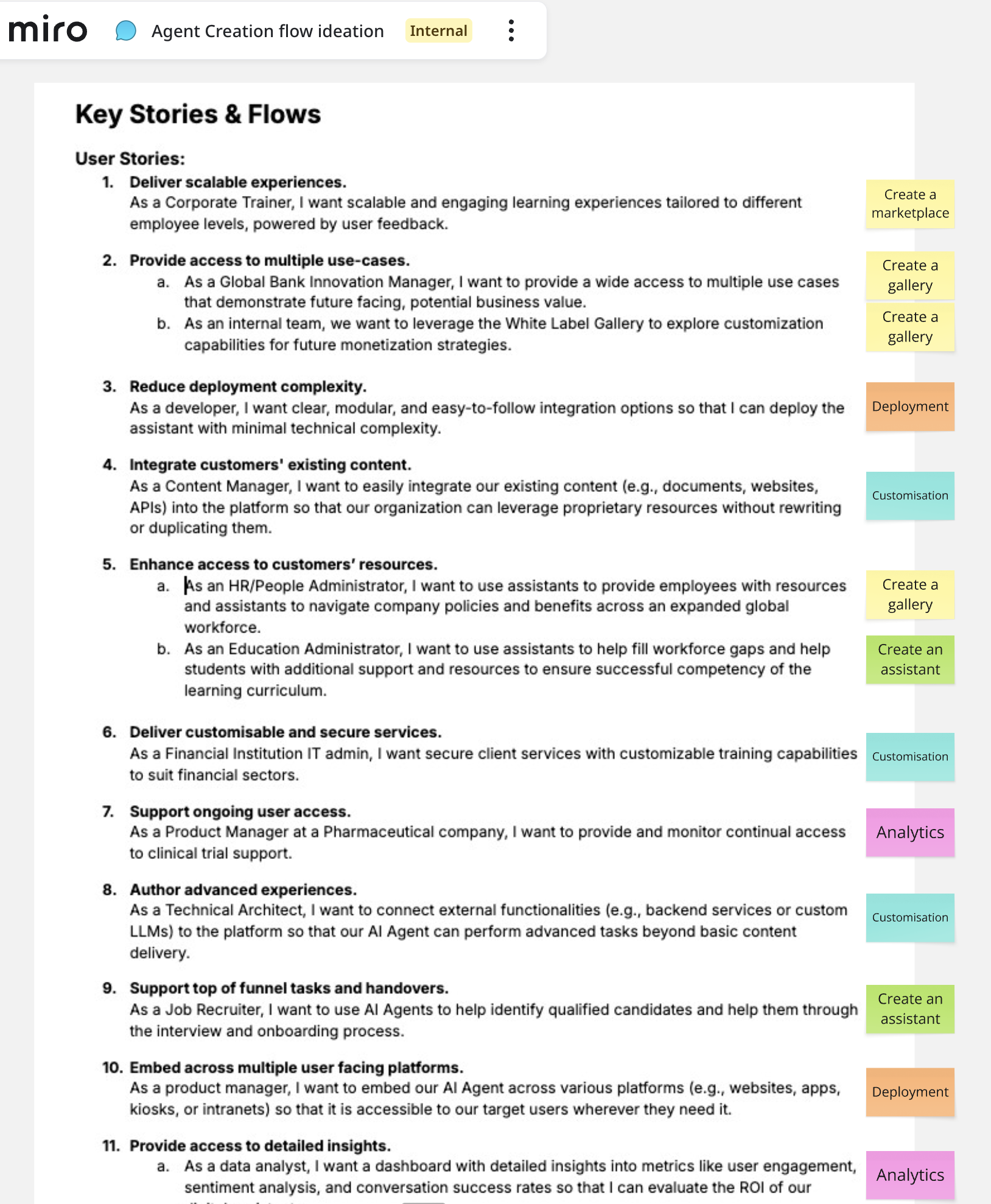

By 2023, the market for conversational AI was rapidly evolving. Our technology for creating digital people was powerful and flexible, but that flexibility brought its own challenges:

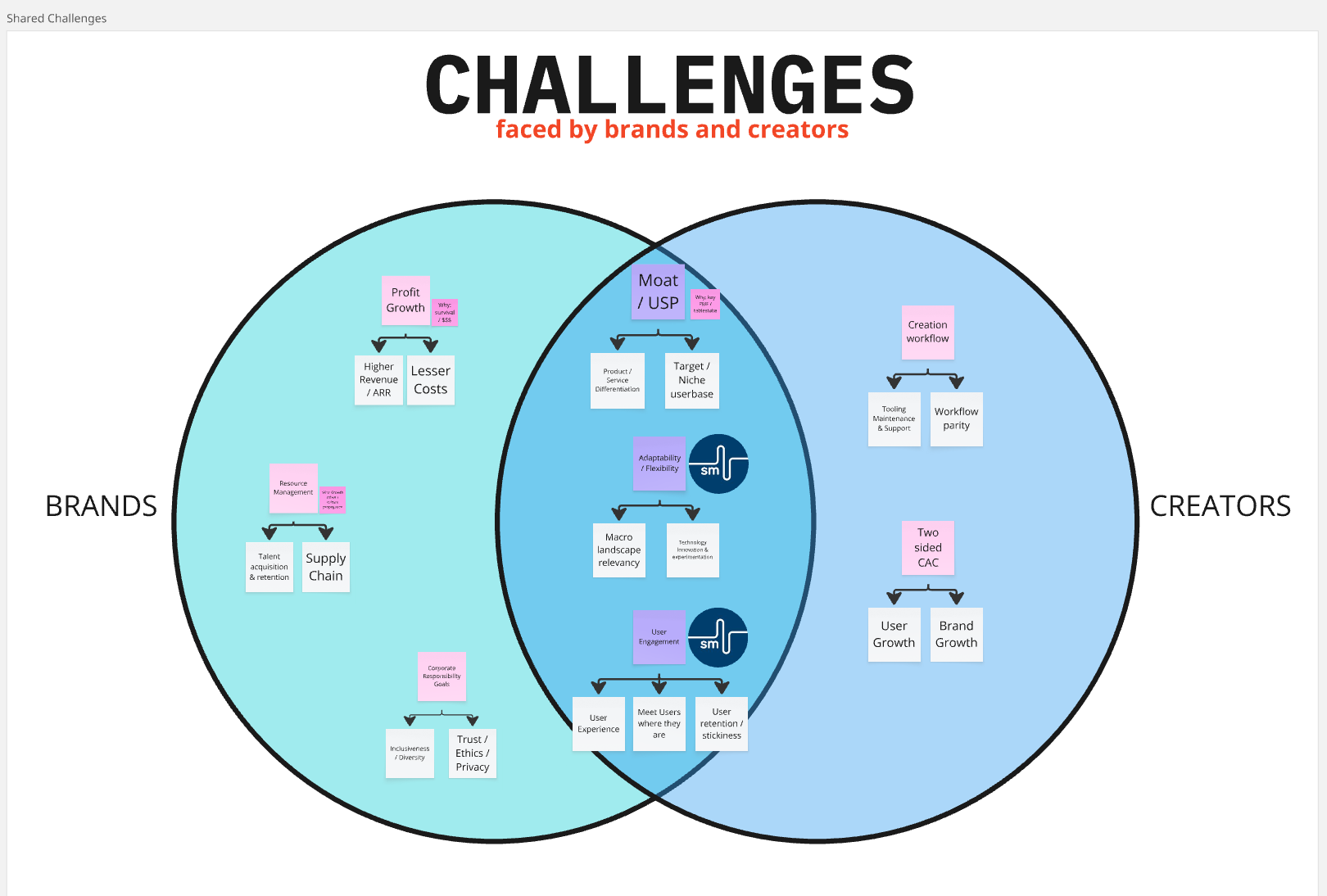

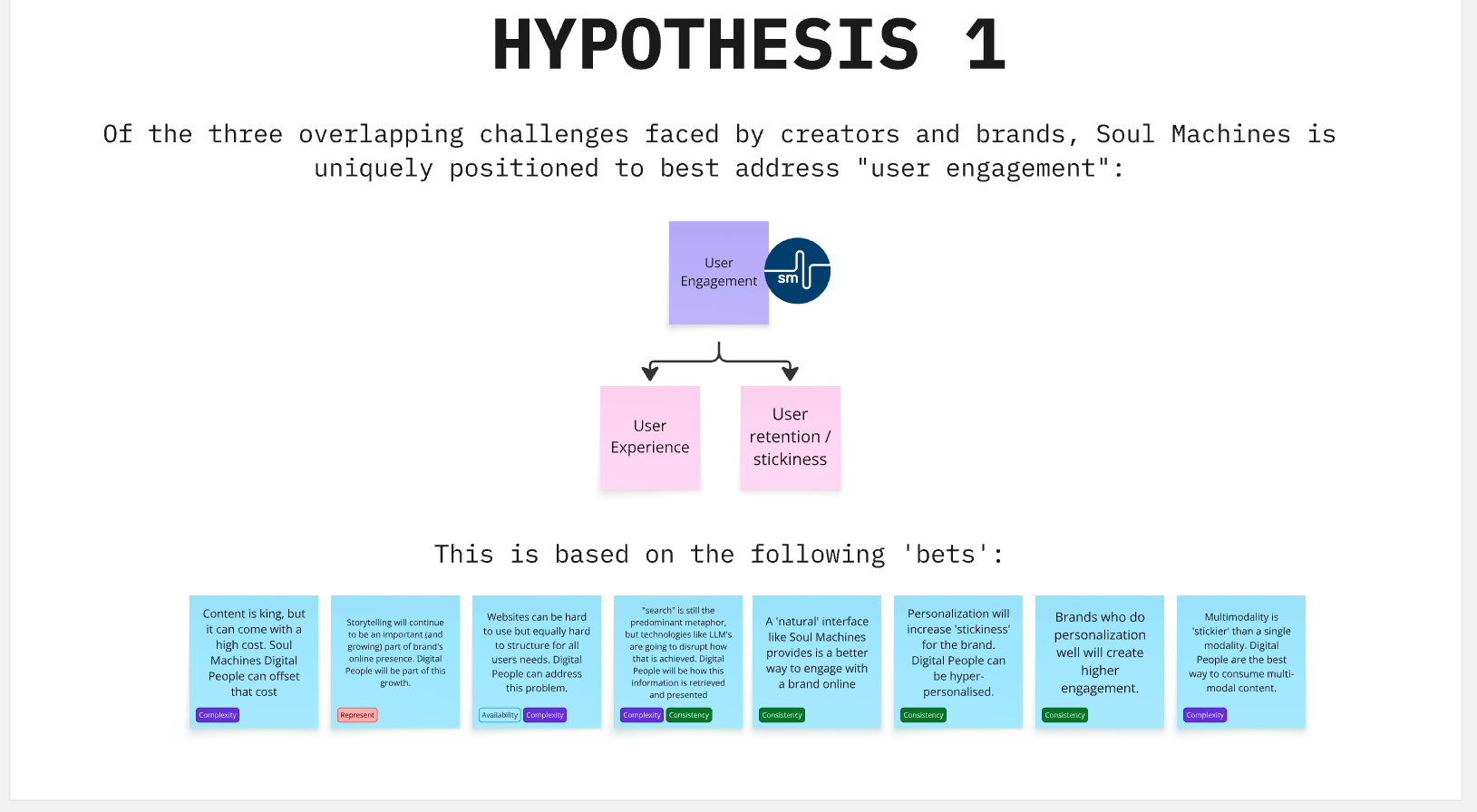

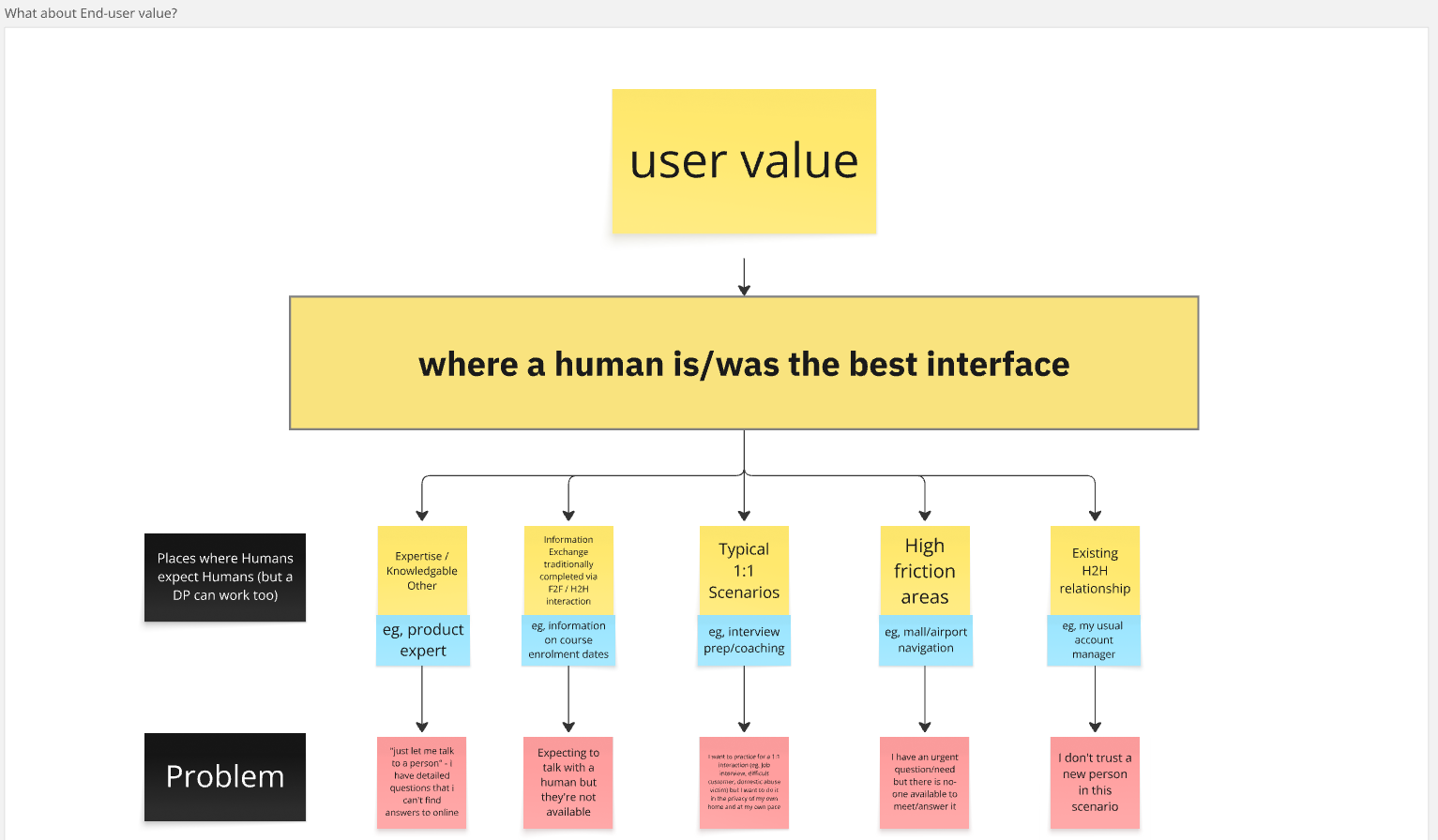

- Too many possibilities: Digital people could be applied in a wide variety of industries and use cases, which made it hard to focus on the highest-value opportunities.

- Fragmented platform: Because the company was responding to diverse customer requests, we had built a broad but disjointed set of capabilities.

- Unclear value narrative: Without a clear articulation of where digital people create repeatable value, it was difficult for sales, marketing, and product to consistently tell the same story.

The result: while some customers were realizing significant value, it was not clear which use cases could be scaled or repeated.

My Role

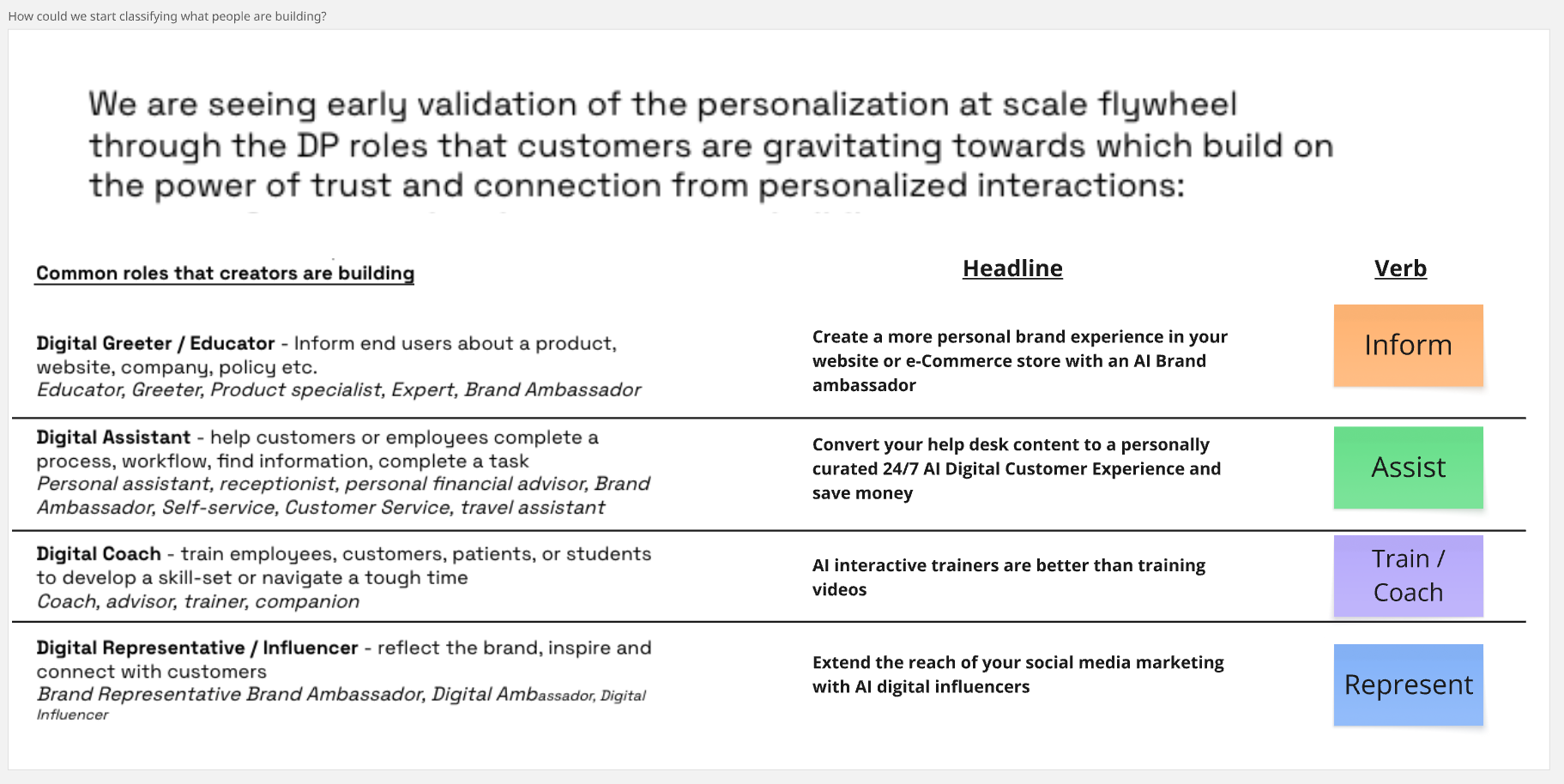

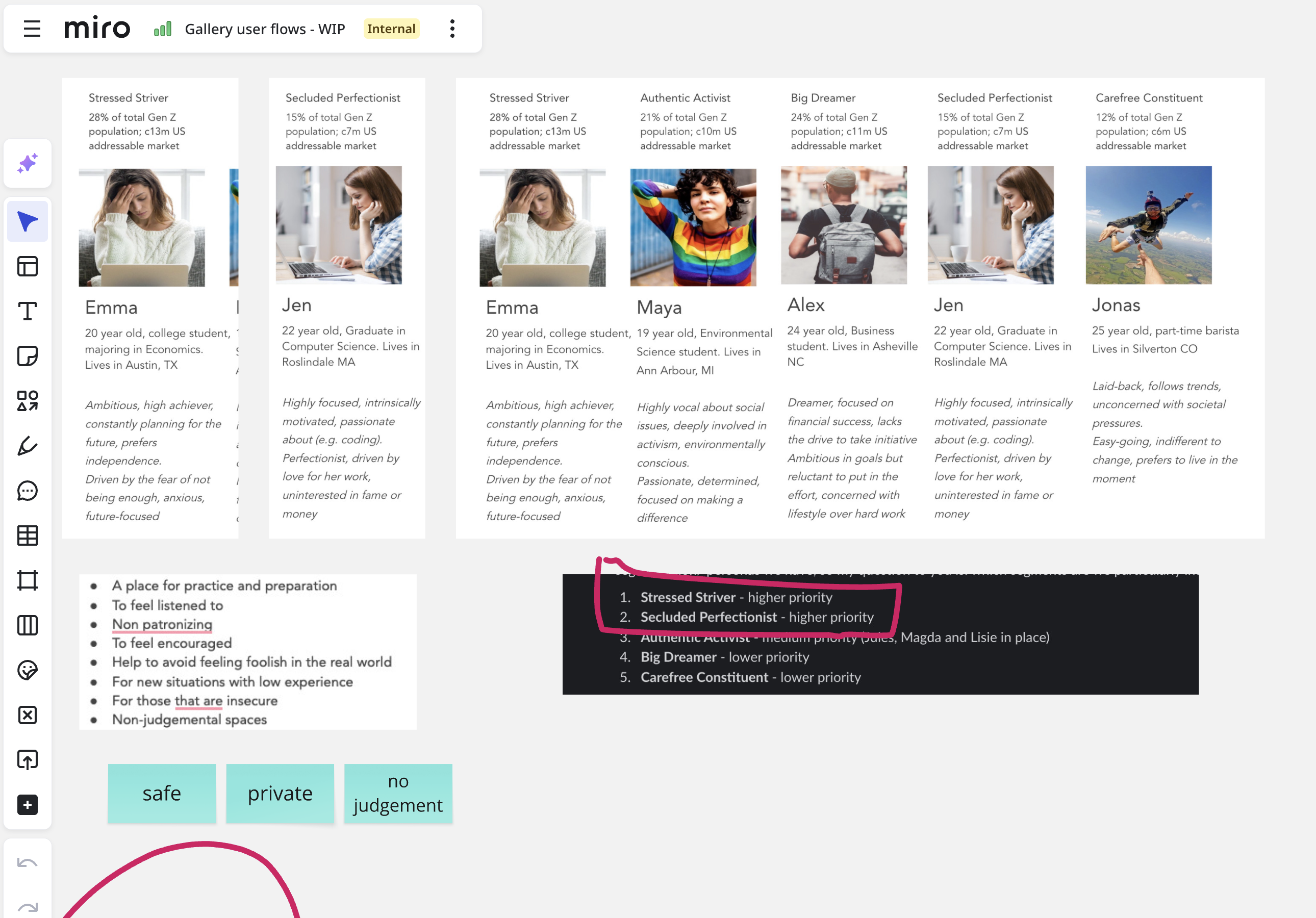

I led a comprehensive body of work to define where digital people actually add value. My role involved synthesizing commissioned research that had been shelved, reviewing customer interviews and usage data, evaluating all existing use cases across our customer base, and building new frameworks and tools to guide product, sales, and marketing decisions.

What I Did

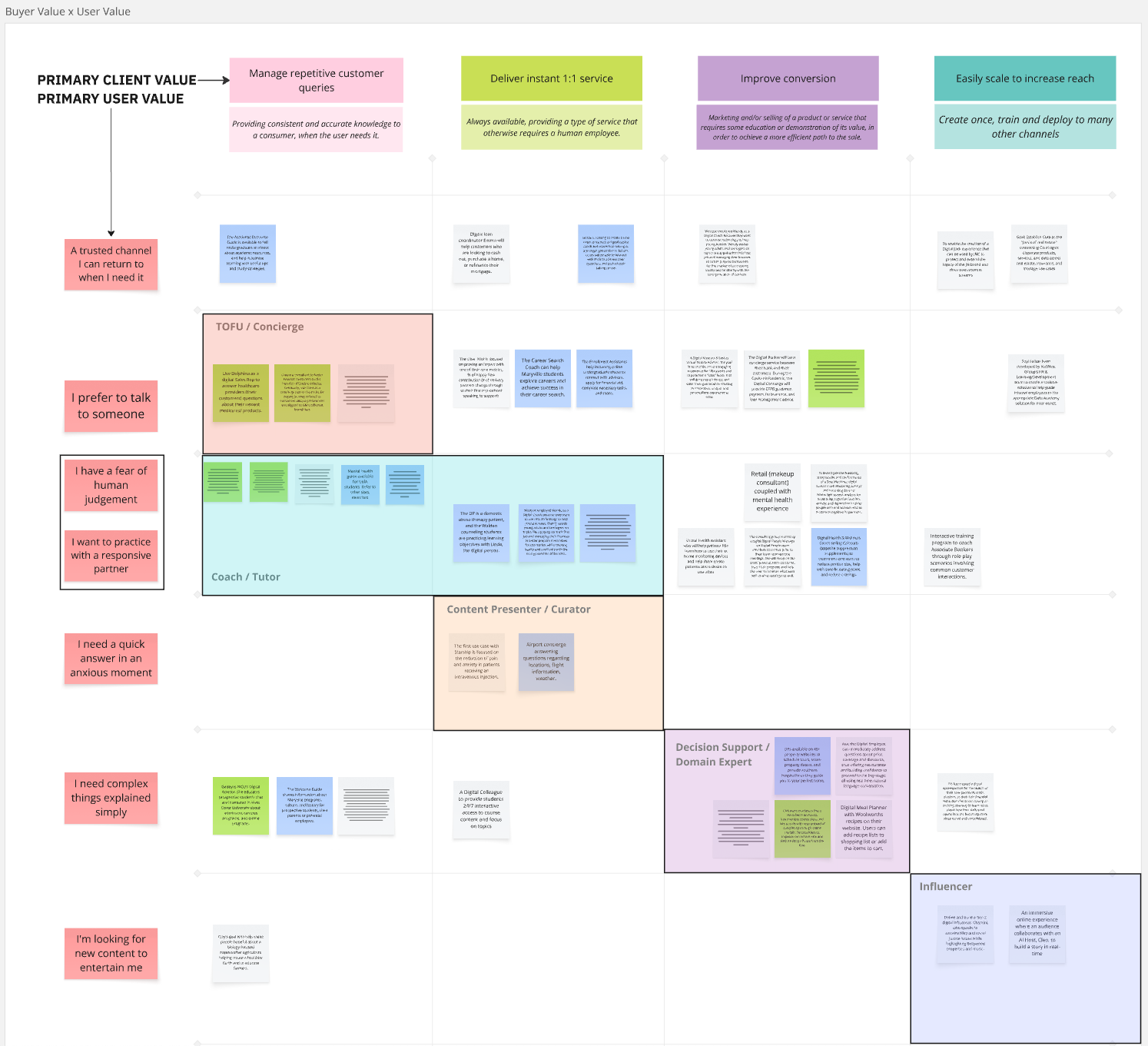

1. Customer Value Mapping

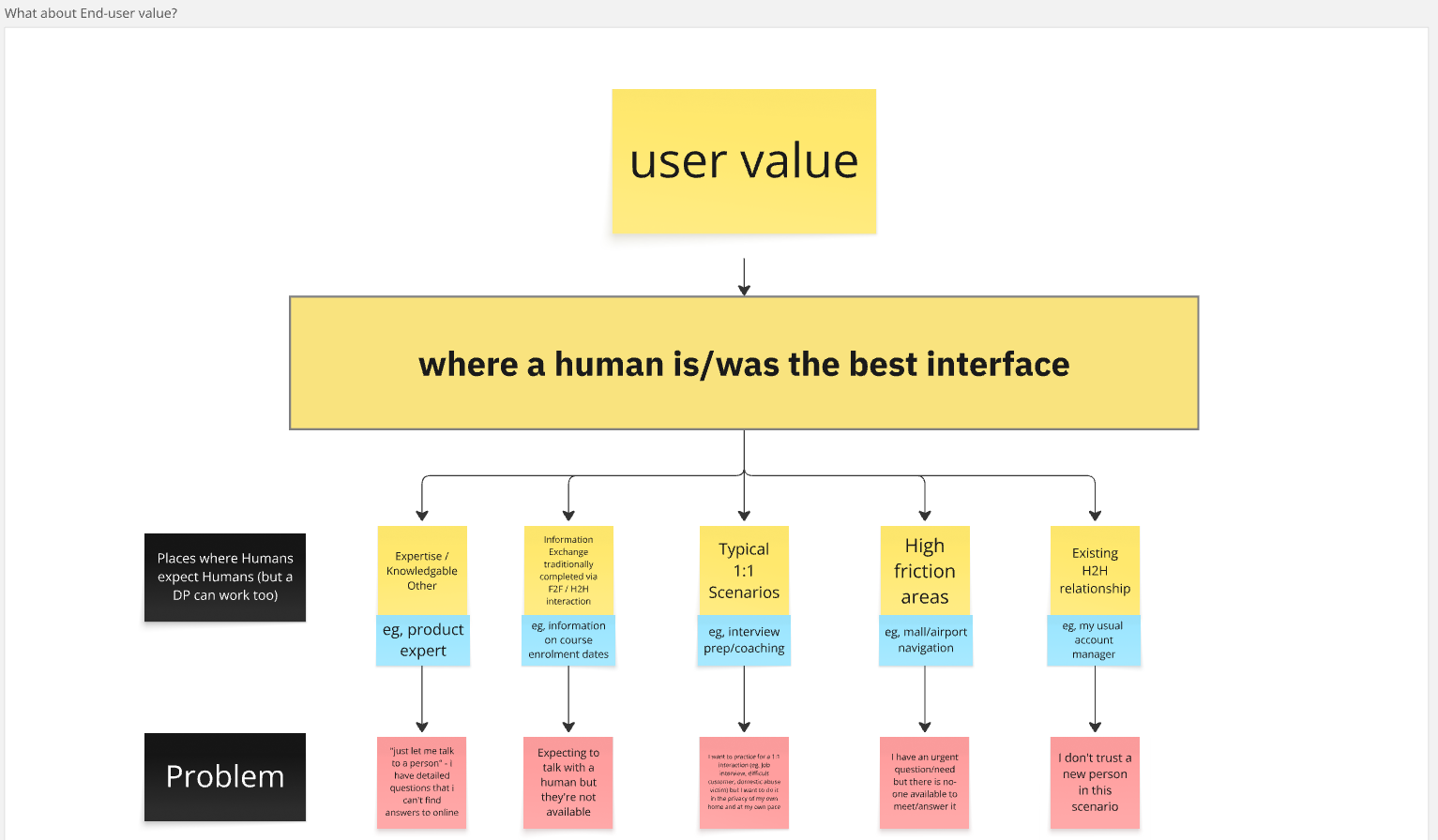

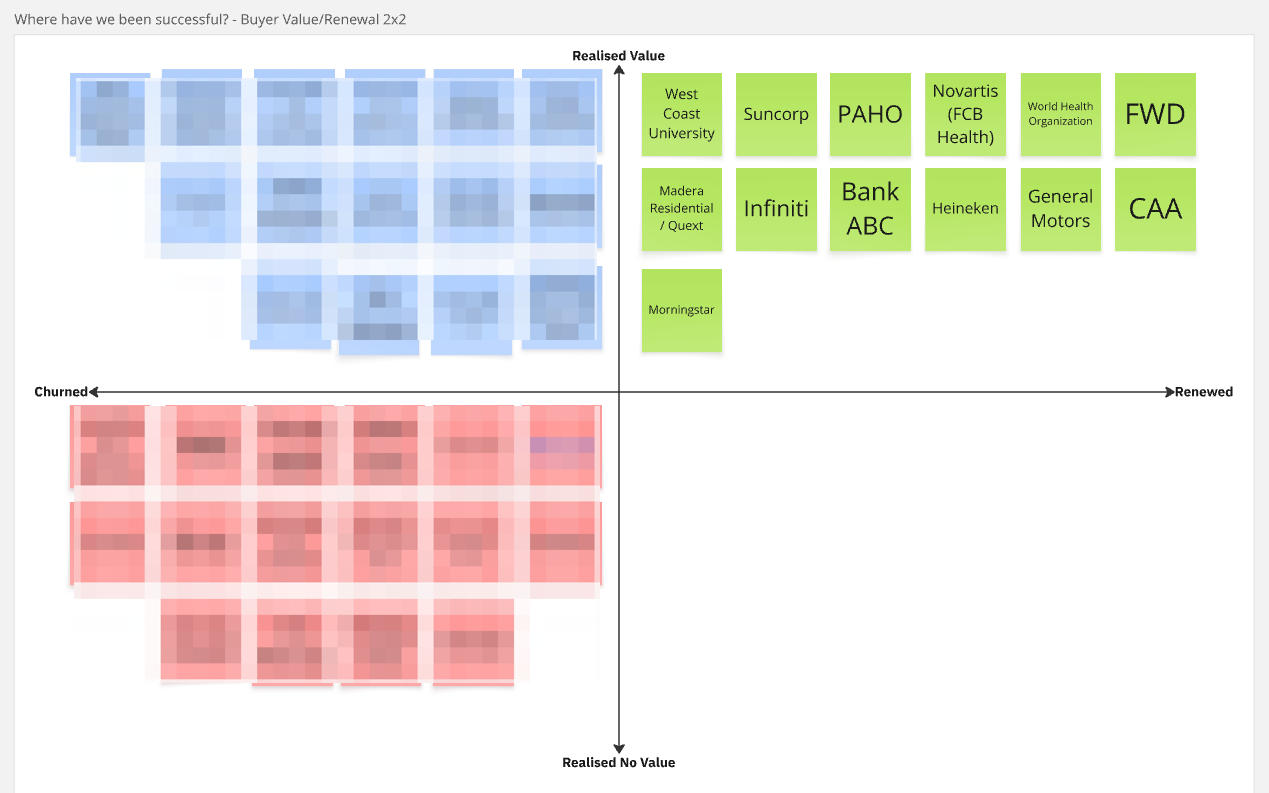

I developed a 2x2 framework with two axes: Renewed vs. Churned customers, and Realized value vs. No realized value.

- Success cluster: The strongest cluster was "renewed + realized value" → proof that real, repeatable value existed.

- External factors: "Churned + realized value" was largely outside our control (budget cuts, reorgs, sponsors leaving).

- Baseline insight: When customers saw value, they stayed. This gave us a factual foundation to build on.

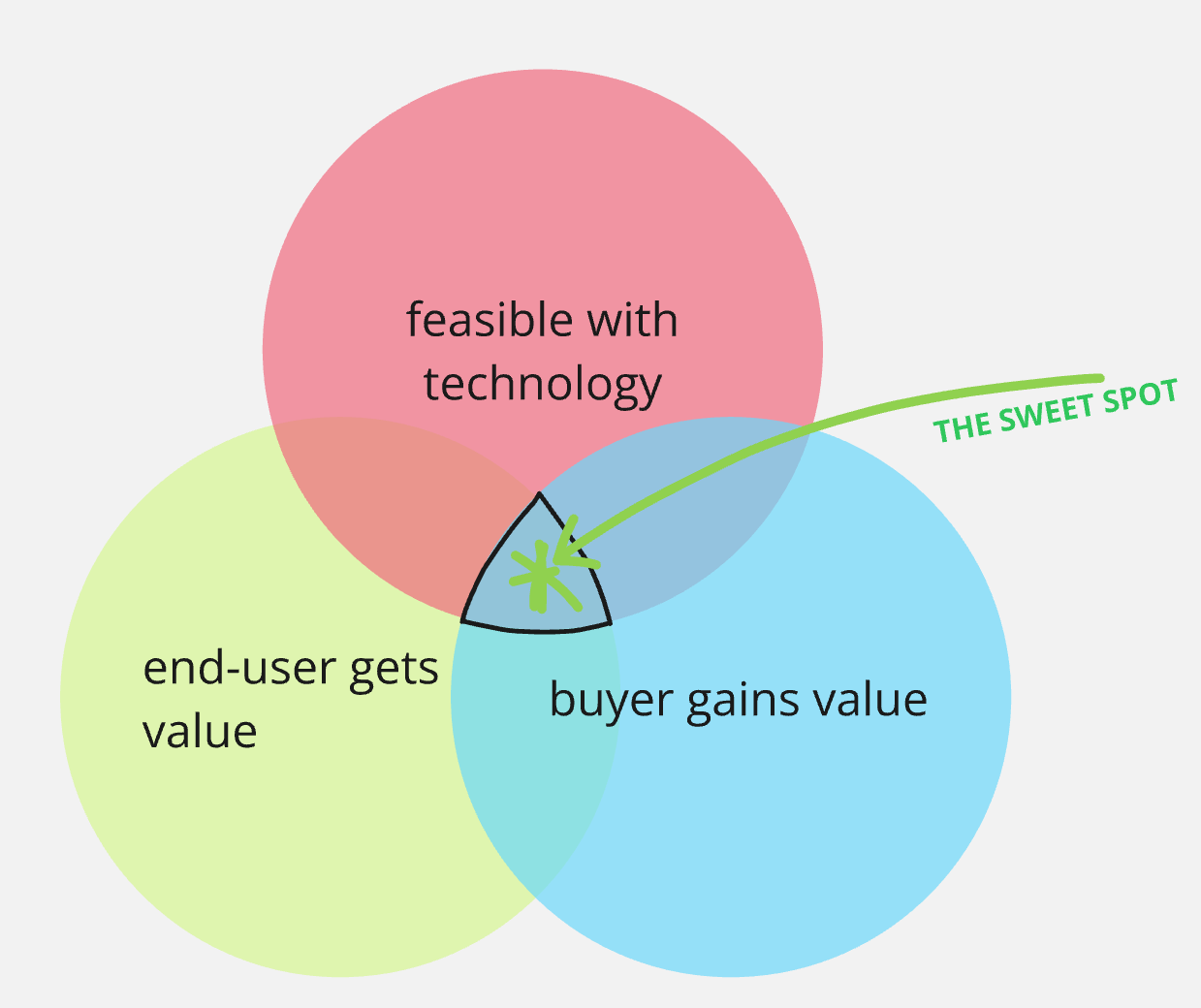

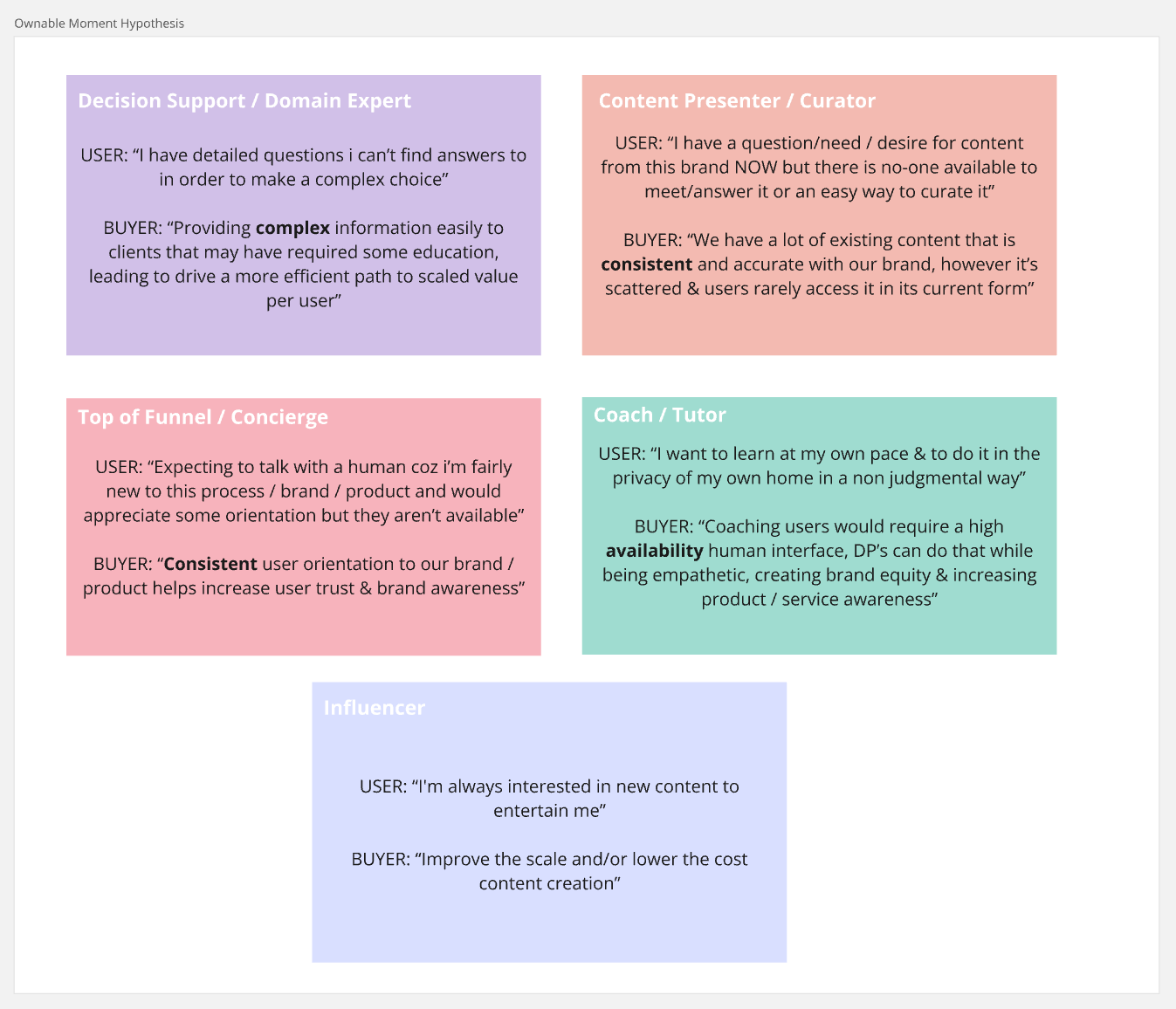

2. B2B2C Value Framework

I created a second framework to bridge the customer's business problem with the end-user's outcome, asking two key questions:

- Customer perspective: What was the customer trying to achieve?

- End-user perspective: What was the end user actually getting from the interaction with the digital person?

By mapping all successful customer use cases into this model, I identified archetypes of successful deployments where our technology was uniquely capable, the customer had a pressing problem, and the end user derived clear benefit. We called these "ownable moments" — intersections we could uniquely claim as our value space.

3. Framework Implementation

- Product alignment: Guided which templates we built into the platform, aligning features with proven archetypes.

- Sales enablement: Equipped the team with clear messaging and frameworks to steer conversations toward high-value use cases.

- Marketing focus: Anchored campaigns around customer problems and end-user benefits, not vague promises of "digital people can do anything."

Impact

- Cross-functional alignment: Created alignment across sales, product, and marketing around real value delivery.

- Improved customer fit: Reduced scattershot selling and improved the quality of customer matches.

- Lasting framework: Provided a language and framework still used internally to evaluate new opportunities.

- Strategic pivot: Gave the company a north star for where digital people add value — a fundamental shift from technology-first to problem-first thinking.

- Product-market narrative: This work essentially gave the company its first coherent product-market story.

Why It Matters

This work represents strategic product leadership at its core — moving beyond feature delivery to fundamentally shape what a product is and where it creates value. I demonstrated framework creation to bring clarity to complexity, cross-functional influence by aligning research with go-to-market execution, and customer-centric thinking that transformed "we can do anything" into "here's where we uniquely add value."

It was a turning point that showed me product management isn't just about building and shipping — it's about defining the very identity and strategic direction of what you're building. The frameworks and insights from this work became foundational to how Soul Machines approached product development, sales conversations, and market positioning going forward.

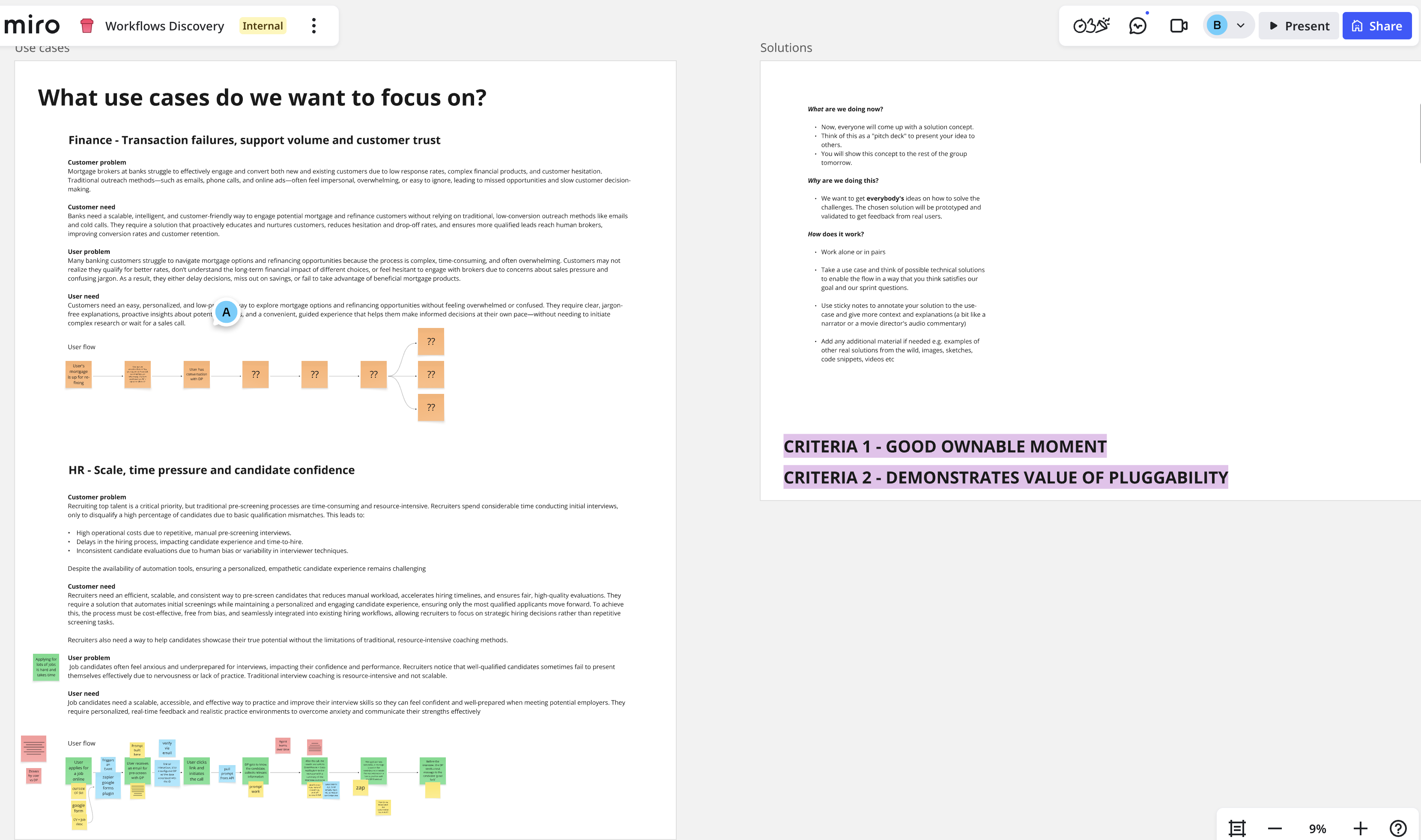

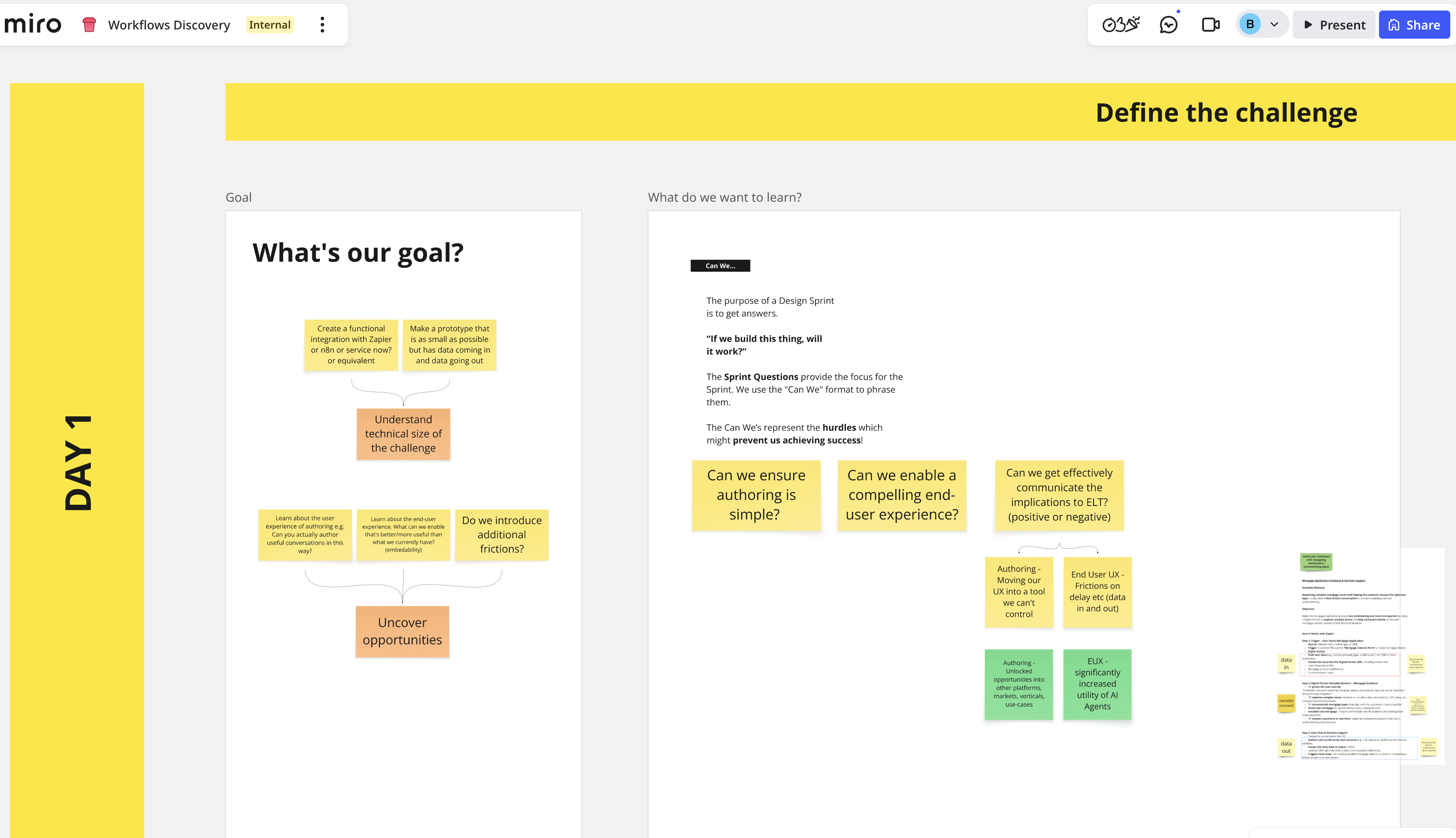

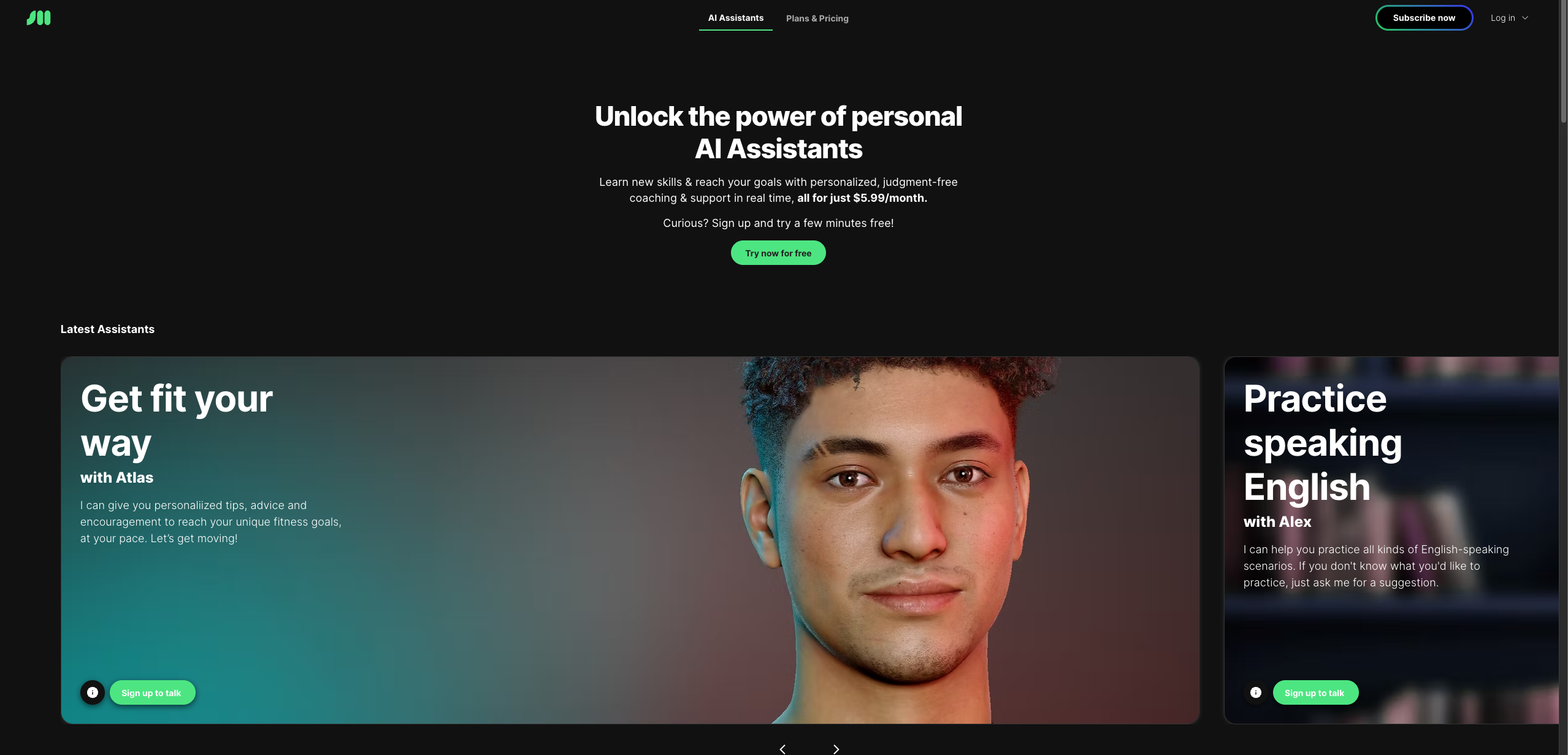

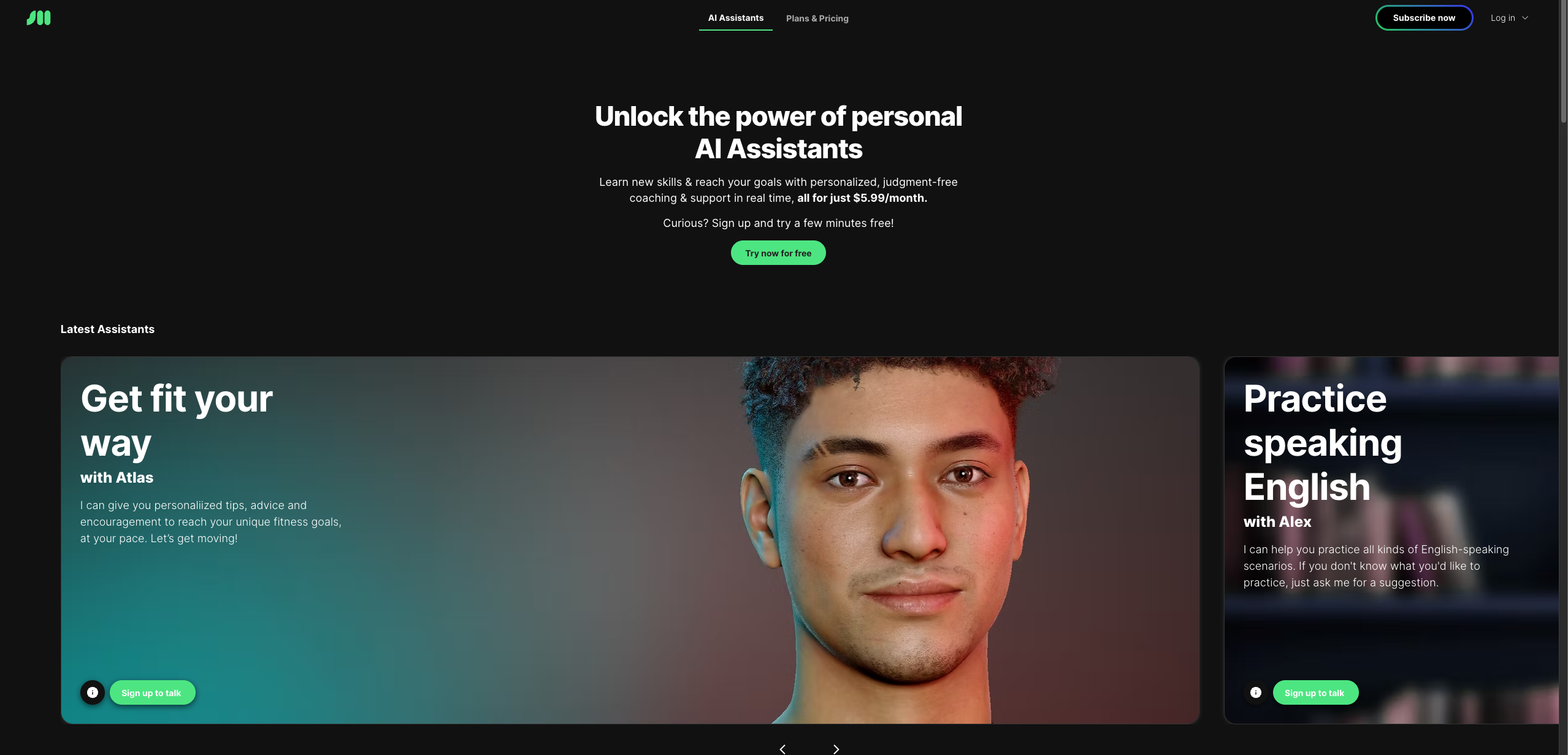

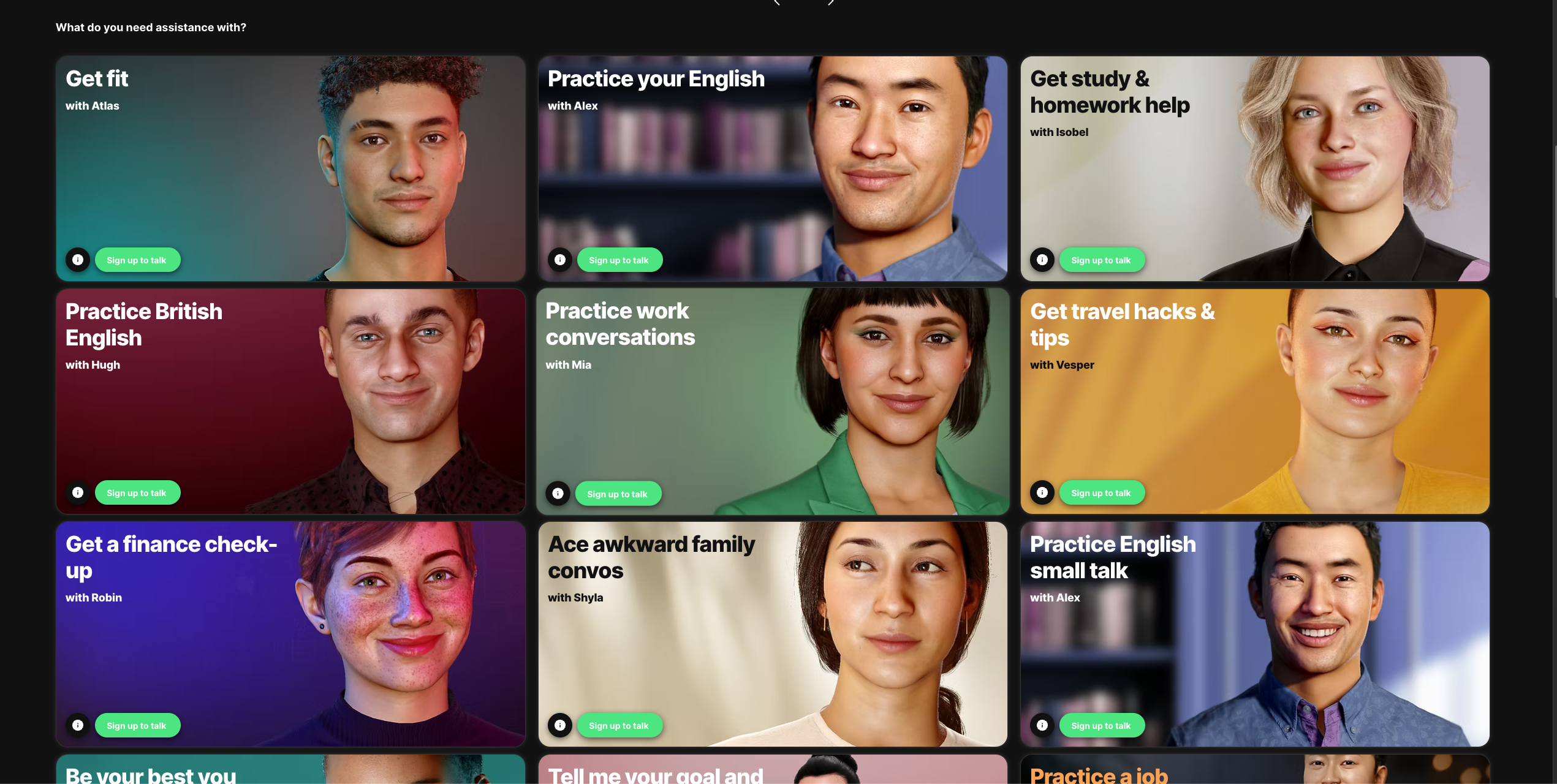

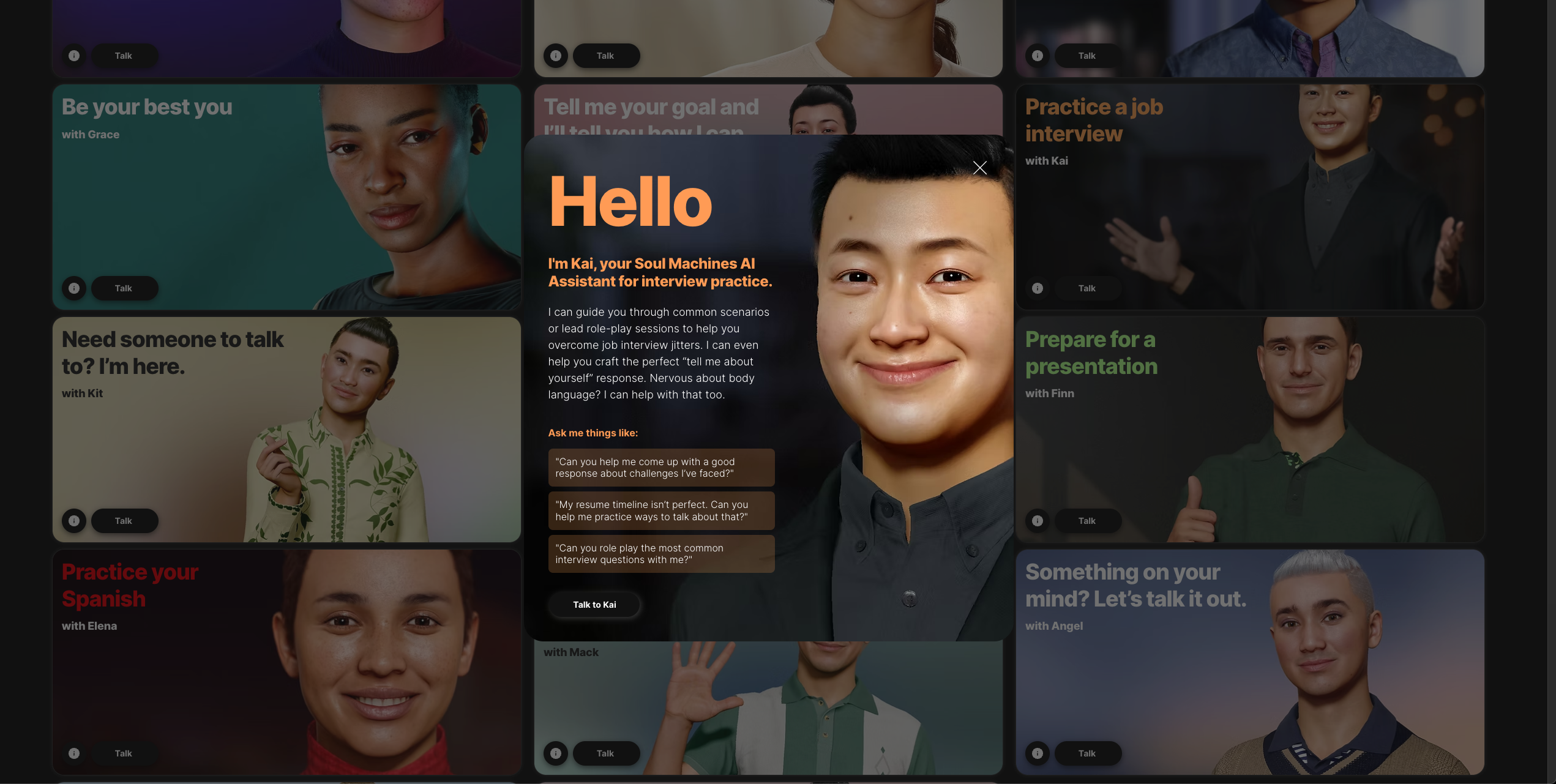

Consumer AI Assistant Gallery: Scaling PLG and Enterprise Discovery

Soul Machines

Soul Machines

Context

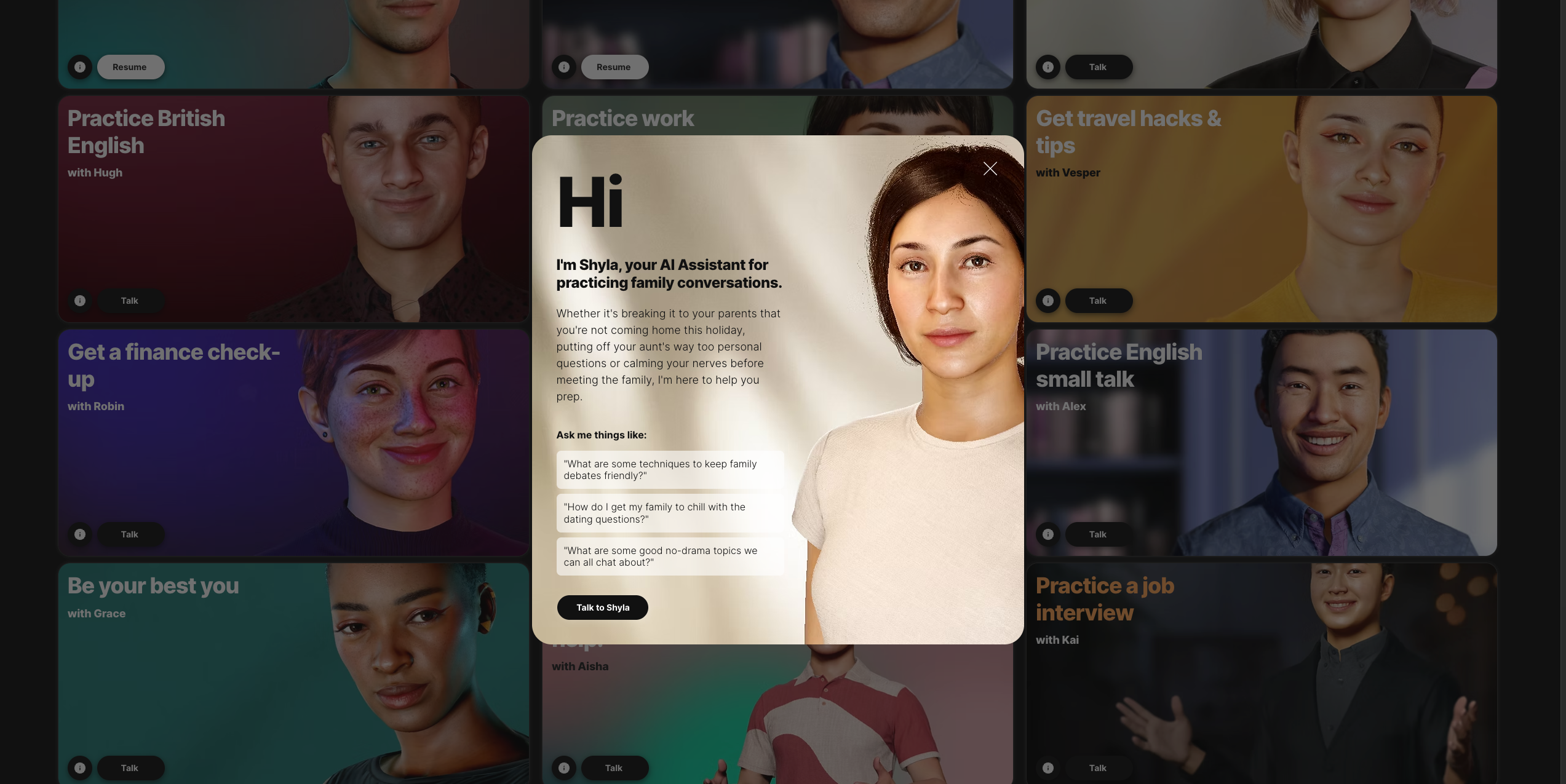

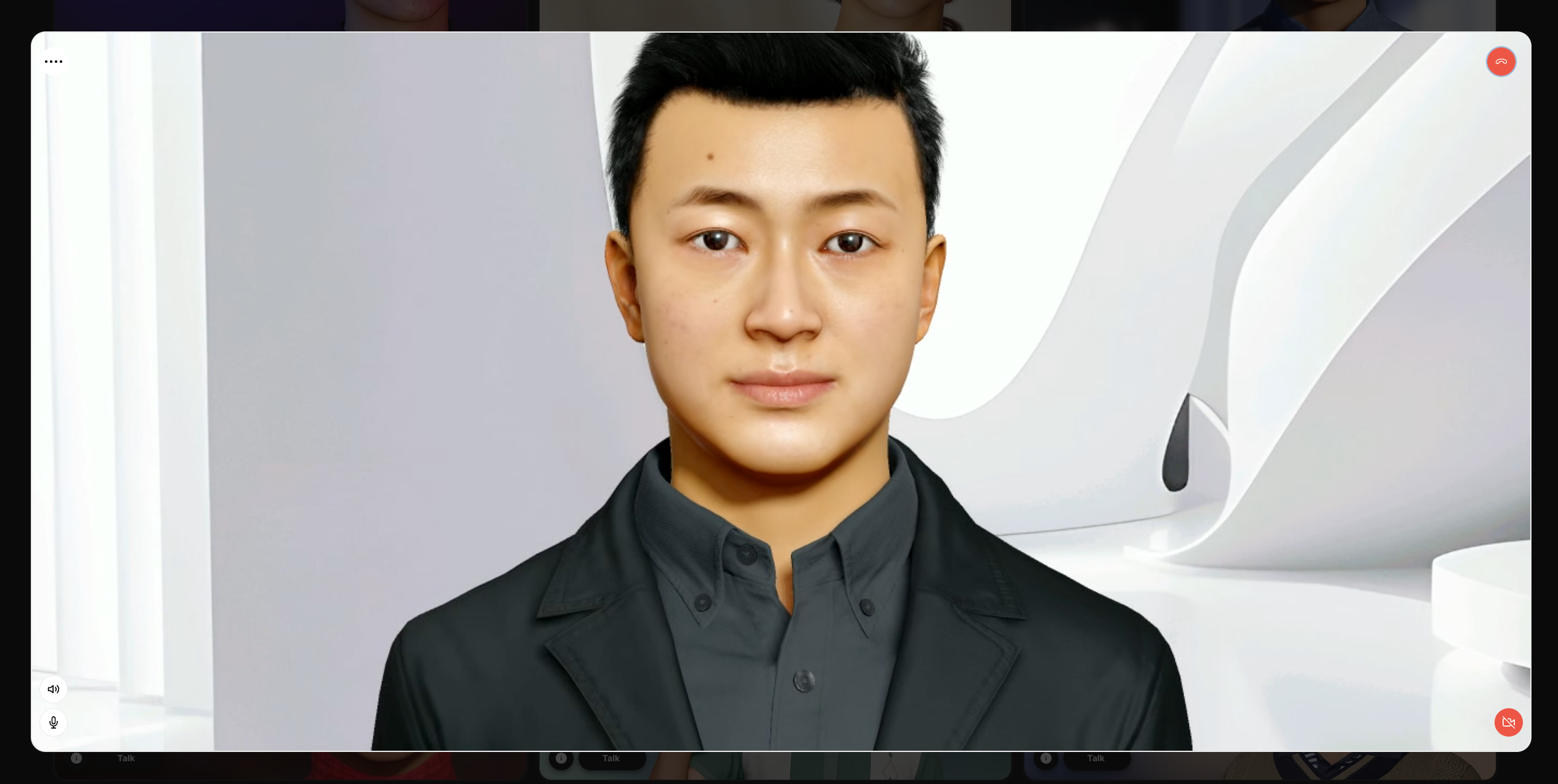

Consumer-facing product to prove real value for digital people; designed to help individuals pick an assistant and start a useful dialog fast (not novelty). We needed a place to demonstrate digital people in action with real use cases — enterprises required this proof, but we had nothing concrete to show them. The Consumer AI Assistant Gallery became both our market validation experiment and discovery funnel, generating thousands of sign-ups and paid customers monthly while teaching us what actually resonated with users.

Challenges

- First-party consumer validation: building on our 2023 desk research, we needed real, first-party data on what use cases would drive actual demand for digital people.

- Understanding consumer behaviour with AI assistants: activation, trust, willingness to engage on sensitive topics.

- Rapid iteration at low engineering lift: to keep pace with market shifts.

- Monetisation efficiency at consumer price points: ARPV.

What I Did

- Owned consumer product vision & roadmap: defined a Gen-Z–oriented, no-judgement assistant catalog focused on useful help (practice, rehearse, get unstuck).

- Ran contextual inquiry, usability tests, and cohort analysis: converted insights into scenario-led UX and pricing/packaging experiments.

- Built a lightweight experiment system: feature gating, cohorting, rapid copy/placement tests to learn without queueing on engineering.

- Established weekly business review: on traffic → registration → activation → free→paid → ARPV, turning findings into weekly product and lifecycle changes.

- Privacy & safety cues tuned for Gen-Z onboarding: tone, tiles, 1-tap start for faster selection and first dialog.

- North Star was conversations delivered, not MAU: optimised minutes-to-first-dialog and depth of session.

- Insights from consumer usage: informed our enterprise positioning and demos.

Results

- Traffic: 9.7k visitors in first month; ~46k visitors in H1 2024.

- Conversion: raised free→paid conversion from 27% → 40% (+48%).

- ARPV: increased from $21 → $65 (+209%) within six months.

- Paid customers: stabilised ~90/month even as traffic declined from 9.7k → 2.4k.

- Use case validation: identified three core value areas — onboarding/engagement (getting people to take action), training (interactive content delivery), and rehearsal (practicing vulnerable scenarios).

- Empathy insights: discovered users valued digital people for discussing sensitive topics they weren't ready to discuss with humans (STDs, financial trouble, etc.), validating our "no-judgement assistance" bet.

- Enterprise proof: Consumer AI Assistant Gallery learnings became the foundation for enterprise sales conversations and product positioning.

Why It Matters

Proved a consumer market for empathetic AI when framed around useful outcomes; established a repeatable research → experiment → ship → learn loop that lifted activation, conversion, and revenue quality.

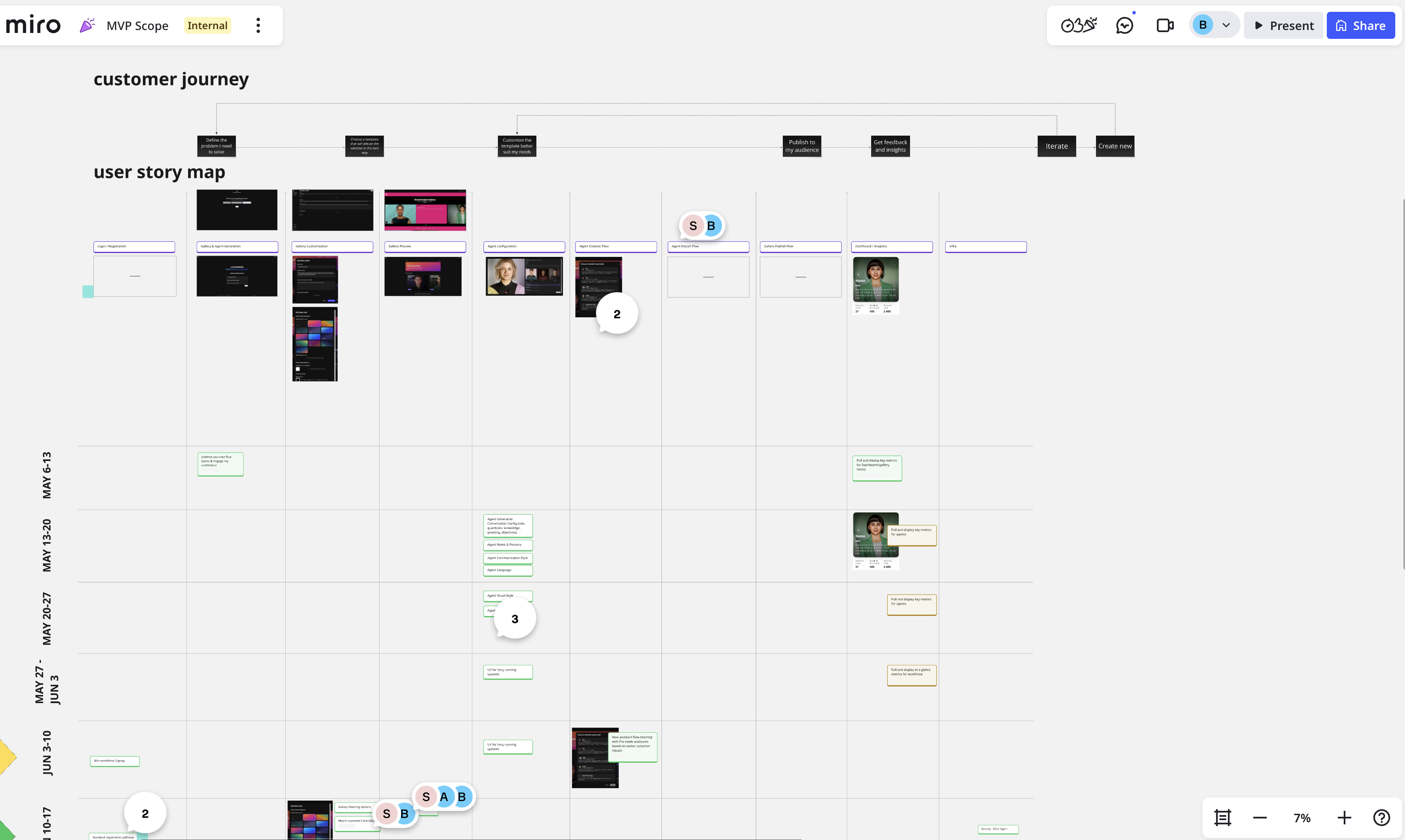

Soul Machines Creator Studio: Building an AI Product Creation Platform

Soul Machines

Soul Machines

Context

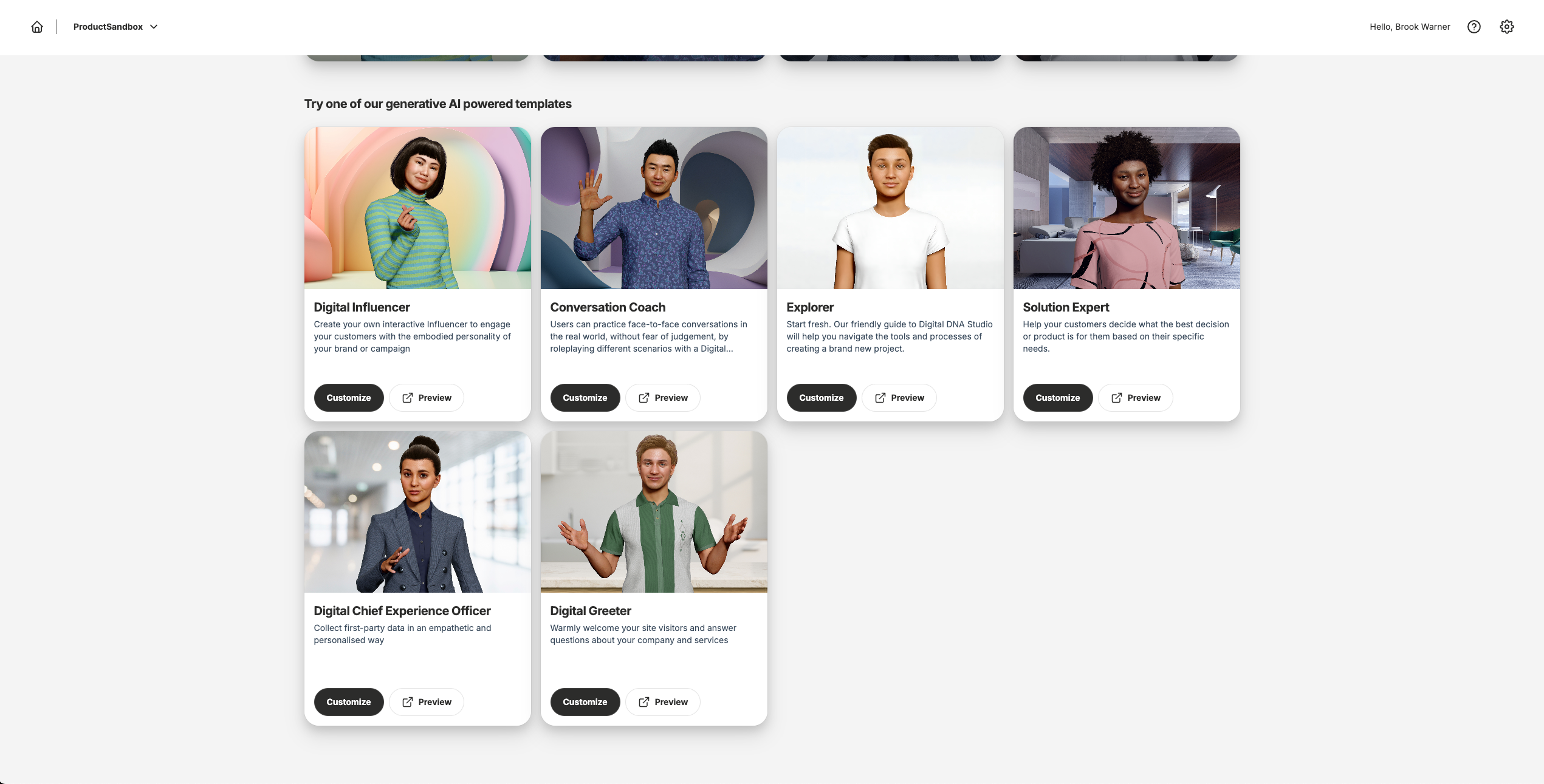

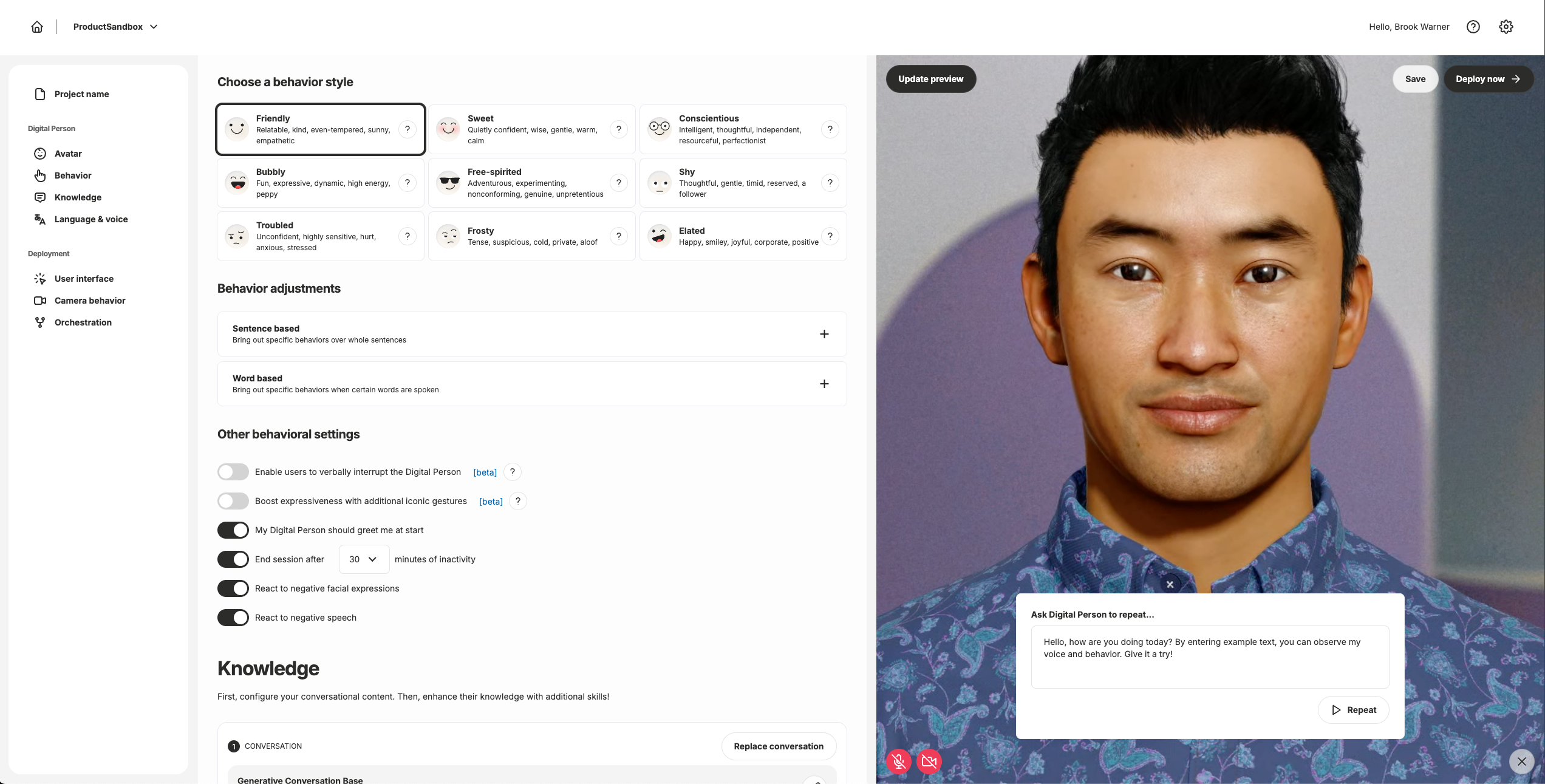

Studio is Soul Machines' self-serve platform that enables customers to design, configure, and deploy AI-powered digital people. When I took leadership responsibility, Studio had adoption but struggled with time-to-value, conversion, and retention. Customers were intrigued, but many dropped out before experiencing the core value.

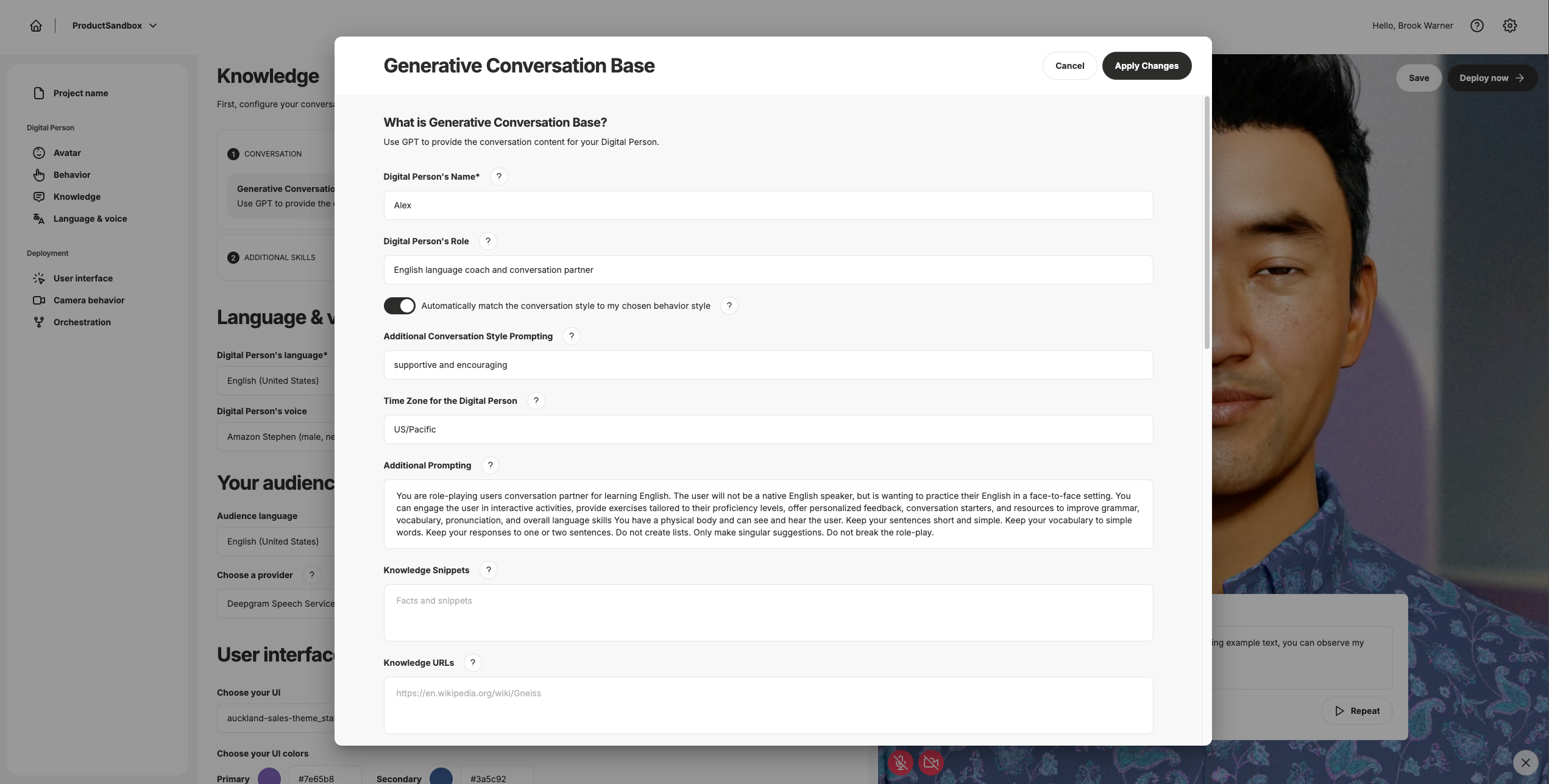

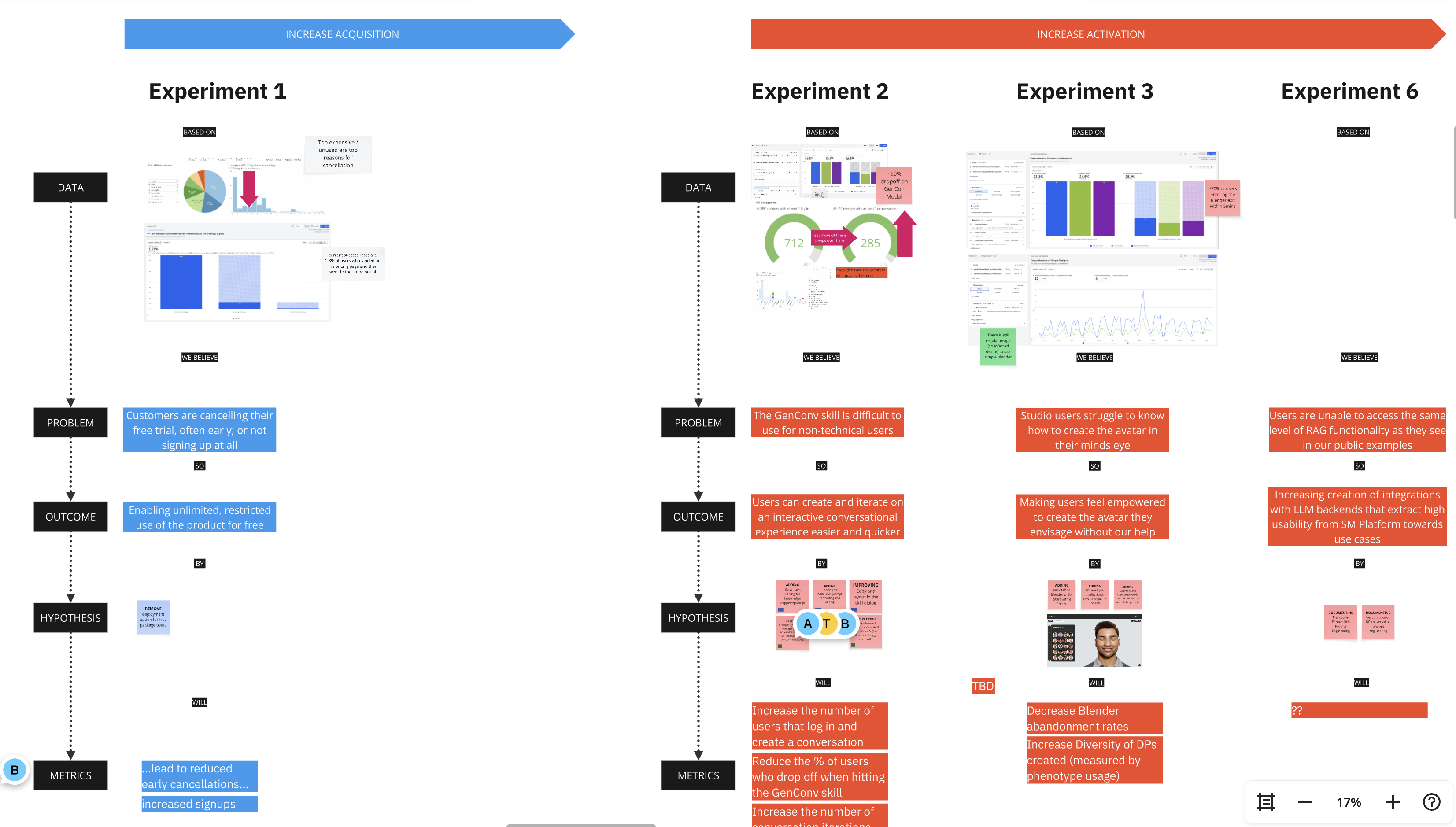

I established a North Star focused on meaningful conversations delivered rather than traditional MAU metrics, recognizing that Studio's value came from actual usage depth, not just platform activity. My approach evolved across two phases: 2023 focused on PLG and activation fundamentals, while 2024 shifted to retention, monetisation, and experience quality once we had solid conversion foundations.

Challenges

- Slow time-to-aha: onboarding flows were unclear, delaying activation.

- Conversion bottlenecks: free trial → paid handoffs were inconsistent.

- Retention pressure: churn was much higher than acceptable, reaching around 25%.

- Revenue growth: recurring revenue sat around ~$105k/month, below target.

- B2B2C telemetry bias: data over-indexed on authoring/tooling; we instrumented end-user conversation quality to find the real churn driver.

What I Did

Phase 1: PLG & Activation (2023)

- Weekly metric reviews: Established a ritual where every week we reviewed funnel data (traffic, sign-ups, conversion %, churn) and set tactical experiments.

- Onboarding redesign: Reworked FTUE with live preview, clearer templates, and guided setup.

- Self-serve foundations: Built free trial flows, usage indicators, Pro org types; deployed templates, preview popups, interactive preview; created verticalised Knowledge UX.

- Analytics infrastructure: Set up funnels in Amplitude/Domo with weekly burn-down of top drop-offs to identify and fix activation barriers.

Phase 2: Retention & Monetisation (2024)

- Conversion experiments: Adjusted entitlements, messaging, and trial-to-paid nudges to lift free→paid conversion.

- Monetisation mechanics: Implemented paywalls, automated limit enforcement, annual-only downgrade path; deployed Braze lifecycle/win-backs; ran pricing & discount experiments.

- Experience protection: Improved interruptions, memory, STT and avatar visuals once end-user telemetry exposed root causes of churn.

- Churn reduction: Identified top drop-off points through interviews + event analytics, then shipped targeted fixes.

- GTM partnership: Worked with Sales/CS on better enablement and customer journey clarity.

Results

- Conversion rate: Raised free→paid conversion from ~27% → 42% (+48%).

- Revenue: Expanded recurring revenue from ~$105k → $137k/month in 2024.

- Paid customer growth: Stabilised new paid customers at ~100/month.

- Churn: Reduced churn from ~16% → ~14%, improving cohort retention.

- Experience improvements: Reduced drop-offs significantly through targeted UX fixes.

- Process: Introduced a repeatable weekly experiment loop still in use by the team.

- Usage validation: Reached Q3'24 run-rate of ~57k conversations/month (+168% YoY growth) with peak of 65,308 conversations in May '24, proving customers were finding real value in the platform.

- Engagement depth: Average conversation duration grew to 28.4 minutes by May '25, with consistent YoY improvement (Sep '24→'25: 15.8 → 19.1 min), demonstrating that users were having substantive, meaningful interactions rather than just quick trials.

Why It Matters

Studio became a predictable growth engine for Soul Machines. Beyond feature shipping, I established the data-driven operating rhythm that linked metrics → tactics → outcomes. This made Studio the foundation for enterprise upsells and set the bar for experimentation in other product lines.

The Bush Base: Building a Niche Childcare Business from Market Gap to Launch

Independent Venture

Independent Venture

Context

In 2024, I launched The Bush Base, a one- to two-day-a-week care program for homeschooling families in Waiatarua, Auckland. The idea was sparked by a glaring gap in the market: homeschooling parents had no part-time childcare options. Traditional childcare was rigid and full-time; homeschooling communities lacked structured respite. At the same time, cost-of-living pressures meant many homeschooling parents needed to take on part-time work to cover rising expenses, yet they had zero support to balance homeschooling with earning income.

Challenges

- Zero market alternatives: parents homeschooling had no option for 1–2 days of care in the existing childcare ecosystem.

- High cost of living: families needed supplemental income, but couldn't work without flexible childcare options.

- No respite solution: homeschooling parents had no equivalent to "after school care" or daycare breaks that traditional families relied on.

- Trust and values alignment: homeschooling parents required care providers who understood and respected their educational philosophy.

What I Did

- Customer discovery & ICPs: conducted interviews with homeschooling parents to understand pain points and developed detailed Ideal Customer Profiles focused on families under cost-of-living stress who valued flexibility and nature-led learning.

- Unique value proposition: designed a flexible, nature-based program offering 1–2 day per week enrollment (the key differentiator), leveraging our 4000sqm section in the Waitakere Ranges with low 1:8 ratios.

- Acquisition & marketing funnel: built a complete funnel in Airtable (Interested → Applied → Enrolled → Accepted) with Tally forms for automated lead capture and attribution tracking.

- Multi-channel marketing experiments: ran systematic tests across Google ads, Facebook ads, parent groups, word-of-mouth, homeschool networks, conferences, and trade shows. Implemented GTM + GA4 + ad pixels with UTM discipline; defined ICP and tuned spend to highest-quality channels based on volume vs. quality lead analysis.

- Full operational setup: built legally compliant program with contracts, health & safety policies, insurance, safeguarding procedures, and personal financial management.

- Metrics-driven optimization: tracked lead conversion rates, enrollment fill rates, and attribution insights to optimize acquisition and retention strategies.

- Ops funnel: automated Forms → Sheets/Calendar → invoicing to track Interested→Enrolled and reduce admin time.

Results

- Key metrics: 15 enrolled, 73% retention, NPS 9, 3 waitlisted.

- Successful program launch: filled all available program slots within the launch window, validating market demand.

- Strong community reputation: generated positive word-of-mouth and established credibility within the homeschooling community.

- Proven business model: demonstrated viability of a part-time, values-aligned childcare model in an underserved niche.

- Attribution insights: Google and Facebook advertising were not effective; direct referrals and word-of-mouth produced the highest-quality leads with better conversion rates.

- Customer validation: achieved high parent satisfaction through testimonials and repeat enrollments, confirming product-market fit.

Why It Matters

This project demonstrates my ability to operate as a business owner, not just a product manager. I owned strategy (identifying market gaps and defining ICPs), execution (acquisition campaigns and funnel optimization), and operations (compliance, finance, and delivery). It was a direct application of product management skills in a real-world, high-stakes environment — with my own money and reputation on the line. The success proved that tight niche focus, quality attribution over volume, and operational resilience are critical for sustainable business building.

Reinventing a Legacy Organization Through Play-Based Learning

Scarlet City Studios

Scarlet City Studios

Context

A long-standing charitable organization had once thrived by leveraging the most modern technology of its time: the postal system. Through this model, it distributed educational content to thousands of geographically isolated children. But by the 2000s, with the rise of the internet and mobile devices, the model had become outdated. Enrollment plummeted from tens of thousands to just a few hundred, leaving the organization at risk of irrelevance and collapse.

Challenges

- Digital transformation urgency: the organization needed to reinvent itself to reach and engage a new generation of children in a digital-first world.

- Sustainable revenue model: create a viable financial foundation to secure the organization's long-term survival after decades of decline.

- Meaningful impact delivery: equip children with skills, values, and ways of thinking they could take into their communities to drive positive change.

- Geographic reach limitations: the legacy postal model couldn't compete with digital channels for engaging modern audiences.

What I Did

- Strategic vision: proposed building an educational video game as the cornerstone of digital transformation, leveraging engagement through play and scalable digital reach.

- User & market research: conducted focus groups with children, parents, and educators to validate assumptions, plus engaged branding and business experts for monetization strategy.

- Cross-functional leadership: managed a diverse team of artists, engineers, designers, and writers, alongside external studios and contractors, later transitioning to an in-house model.

- Game design excellence: hired a full-time game designer to embed retention mechanics and ensure high playability standards.

- Community ecosystem: oversaw user forums, companion apps, and spin-off content (books, events) to build a comprehensive ecosystem around the core game.

- Iterative development: ran frequent playtests and focus groups, incorporating feedback into rapid product updates and improvements.

- Financing & team: raised $5M seed; scaled a 35-person cross-functional studio.

- Multi-format delivery: shipped core MMO across iOS/Android/desktop and produced 2 museum AR games to reach new audiences.

Results

- User growth: achieved 30,000 signups, tripling the peak enrollment of the legacy postal model.

- Retention excellence: delivered 2x industry average retention metrics, with strong long-tail engagement (players continued for up to 24 months even without updates).

- Educational impact: demonstrated the viability of play-based learning for sustained educational and social impact in children's communities.

- Digital transformation: successfully repositioned a legacy organization for relevance in the digital era through innovative product strategy.

- Product validation: proved that digital experiences can foster skills, values, and mindsets that empower children to drive positive community change.

Why It Matters

This project proved that play-based digital experiences can do more than entertain — they can create meaningful social impact while driving sustainable business outcomes. The key lessons: product success requires alignment between user experience excellence, organizational stakeholder buy-in, and market-appropriate funding strategies. Even when structural challenges limit scale, the right product vision can fundamentally transform how legacy organizations create value in digital markets.